There is no dearth of peer-to-peer (P2P) payment services on the market nowadays. From companies like Cash App to Venmo, users can choose and use the service that best fits their purpose. However, finding a service that closely integrates with your current banking partner can prove to be a major step towards making your experience seamless. And that is where Zelle fits in.

Launched as recently as 2017, Zelle was created by Early Warning Services, which is a consortium of thirteen of the largest banks in the United States. With Zelle, users can quickly send and receive money by directly linking their bank accounts. During its earlier days, the service met with scepticism since the market already had P2P behemoths such as PayPal and Venmo. But, over time, Zelle’s speed and convenience won customers over.

One of the many ways Zelle stands apart from other P2P payment services on the market is through its collaboration with various banking companies. Since the service is already owned by billion-dollar enterprises such as JPMorgan Chase, Bank of America, and the like, users can ensure the utmost security and confidence when using the service. It is also the same reason why Zelle does not always require its standalone app to be functional since most US banks support the payment service via their own banking apps.

In 2021, Zelle further introduced international payments, where users could send or receive money between banks internationally. Additionally, the service also introduced a new feature through which users have the ability to send money to a selective group of people simultaneously, making it more convenient for users to gift money or share expenses.

However, even with so much going in its favour, Zelle has some limitations that need to be addressed. For starters, users only get a daily spending limit of $2,500 (the limit may vary based on the banking partner), and money can only be sent to people who have a Zelle account. In addition to that, Zelle is currently available only in the United States for customers with a US bank account and a US-registered mobile number, with no plans to expand to other parts of the world. As a result, if you are planning to use Zelle outside of the US, you will not be able to.

With that all being said, if you have been using Zelle for quite some time now and have accidentally sent money to a person who does not have a Zelle account, then you can immediately register a cancellation request by following our guide. Doing so will help you get a refund effortlessly.

Steps to Cancel Payment and Get Refund

According to Zelle’s terms, users can only cancel a payment transaction if the recipient has not yet enrolled with Zelle. This is because when a recipient enrolls with Zelle, the recipient’s bank account also gets connected with the account. As a result, any payment that gets sent will immediately be rerouted from the Zelle account to the recipient’s bank account. And once the payment reaches the recipient’s bank account, cancellation of the payment becomes impossible.

Now that you have a thorough idea of what to expect from Zelle’s payment cancellation policy, it is time to brush over the steps you need to follow to initiate the cancellation of your payment and get a refund.

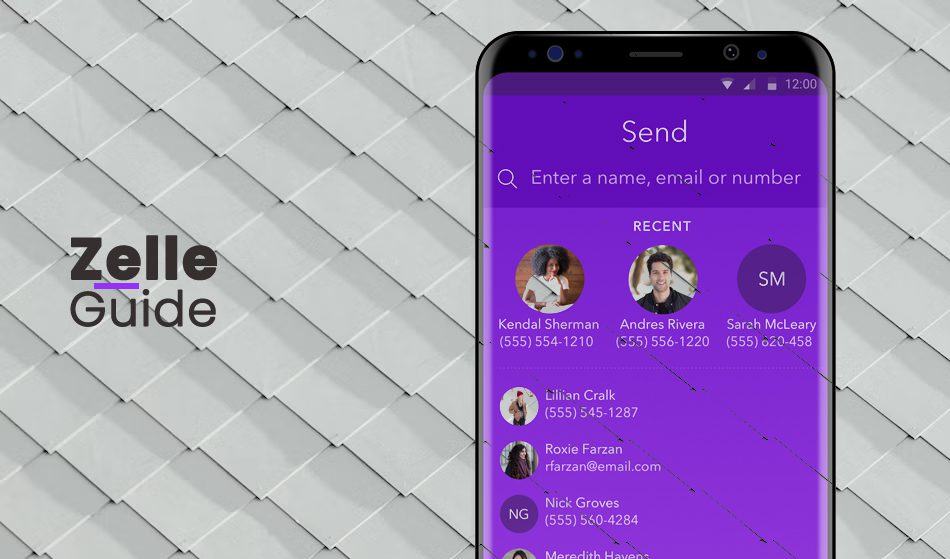

- Kickstart the cancellation process by first downloading the Zelle app on your smartphone from either the Google Play Store or the Apple App Store. Additionally, if your current banking app already supports Zelle Pay, you can directly access it from there. Supported banking apps for Zelle have been listed here.

- Proceed to sign in to the same Zelle account that you used earlier to send the payment.

- Once signed in, head over to your activity page within the Zelle Experience section, either from the Zelle standalone app or your mobile banking app.

- Look for the transaction that you want to cancel. Keep in mind that the transaction must be incomplete to be able to be cancelled.

- After you have found your preferred transaction, proceed to cancel it by clicking on the “Cancel This Payment” option.

- Once you have confirmed the cancellation, the paid amount will be refunded directly to your bank account without any delay.

How to Contact Support?

If you are looking to obtain additional assistance from Zelle’s customer support, then you can do so by simply getting in touch via phone at 1-844-428-8542. Phone lines are live from 10 AM to 10 PM ET throughout the whole week, excluding public holidays such as Thanksgiving, New Year’s Day, Independence Day, and Christmas.

In addition to that, you can also connect with the company’s customer support by filling out the online form here. Do state your full name, your registered email and phone number, and the problem you are facing in detail in the description box. Once done, click on “Send Message”. Expect a response within two business days via email.