The onset of the smartphone revolution in the early part of the 2010s paved the way for the development of mobile-based payment services in Bangladesh. And one of the companies that has been at the forefront of such a change has been bKash.

Launched in 2011, the primary aim of the platform was to provide financial access to the majority of Bangladesh nationals, who lacked traditional basic banking facilities at the time. As a result, bKash, with its accessible and convenient mobile payment service, allowed users to deposit, withdraw, and transfer money seamlessly. Over time, bKash witnessed exponential growth, becoming one of the first country’s start-ups to achieve ‘unicorn’ status.

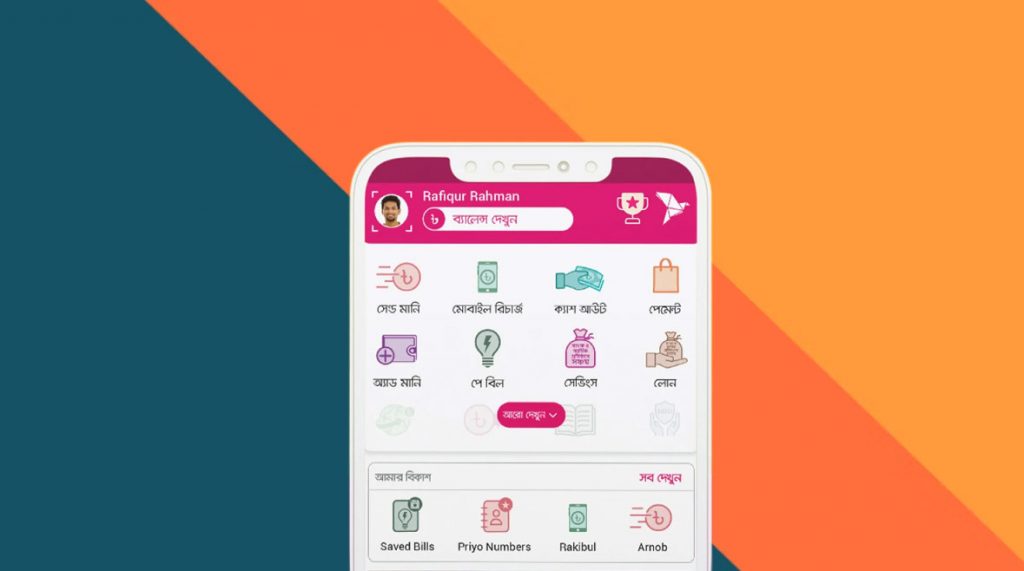

Today, bKash offers a comprehensive suite of financial services, such as online and in-store payments, mobile phone recharges, bill payments, accessing microloans, and sending and receiving international remittances. So, if you are looking to simplify your online payments and use a one-stop-shop for all your needs, then our in-depth guide can help you get started on bKash’s platform right away.

What are the Eligibility Requirements

Starting off, to open a bKash account, you need to be a national of Bangladesh, aged 18 years or older. Additionally, you need to showcase your national ID, driving license, or passport during your sign-up process. Also, keep in mind that having an active phone number is necessary, and your number should be from either of the following service providers: Grameenphone, Robi Axiata, Banglalink, TeleTalk, or Airtel Bangladesh.

Remember that opening a bKash account is free of charge, and you can do that either by yourself via the smartphone app or by visiting any bKash agent or branch.

How to Apply and Activate bKash

Opening your bKash account is a straightforward process, and all you have to do is follow the recommended steps below, and you will be good to go.

- The primary step involves downloading the bKash app on your Android or Apple device, either from the Google Play Store or the Apple App Store.

- Once downloaded and installed, launch the app, and you will be asked to either sign up for a new account or log in to an existing account.

- Proceed to sign up for a new account, and then enter your 10-digit mobile number. Remember, once a phone number is registered for a bKash account, the number cannot be changed. So, ensure that you use the correct one.

- An OTP (One-Time Password) will be sent to the phone number via text message, and once you enter the authentication code, your phone number will be registered on the platform.

- After that, you will be asked to enter your basic information, such as your name, date of birth, residential address, and email ID.

- Once done, you will be required to provide a photo of your ID proof, such as your national identity card, driving license, or passport.

- In the next step, you will also be required to click a selfie to showcase your identity, as mentioned in the ID proof.

- After your identity is verified successfully, your account will be activated, and you will be able to start using bKash’s services without any hurdles.

How to Contact For Help

To get in touch with bKash customer care, you can contact them via phone at 16247 or 02-55663001. Phone lines are available 24×7. Alternatively, you can connect with them via email at support@bkash.com.

In addition to the aforementioned communication channels, you can set up an e-appointment here or start an online live chat with a customer care agent here.

What You Should Know

Now that you have successfully opened your bKash account, it is important to note that you need to set an MPIN for your account. This MPIN protects your account from unauthorized access. However, keep in mind that if you lose or forget your MPIN, you can still reset it by dialing *247# (Option 10) from your registered phone number or by contacting the customer support team.

Additionally, entering your MPIN wrong three times in a row can also block your bKash account, which you need to unlock by carrying out the aforementioned actions as well. Also, in rare cases where you lose your mobile phone (either due to theft or damage) on which your bKash account was active, you need to contact customer support to temporarily block your account until you re-sign onto a different mobile handset.

Finally, when using your bKash account for sending payments, it is always advised to double-check the receiver’s account number (or mobile phone number) and the amount you are sending. This is because once you send the payment or complete the transaction, there is no way to reverse it. So, even if you send the payment to the wrong individual, bKash customer support will be unable to assist you, and you will be required to follow legal ways to recover the payment.