The Income Tax department has issued Rs 1,50,863 crores in refunds to 11.8 million taxpayers of India between April 1 and December 20, 2020. This is a staggering figure, but the fact remains many taxpayers miss out on the chance of refunds owing to the lack of knowledge on how the process works. Ignorance costs them financially. As per the income tax rule, the tax needs to be deducted from the payer at source, at the prescribed rates. These sources can be salary, rent, royalty, commission, interest and others.

In case of salary, TDS (tax deducted at source) has to be in line with the income tax slab, which applies to the particular taxpayer. Once TDS is deducted, it is remitted to the central government accounts, within a particular period. However, in many cases, the taxpayer fails to make a proper declaration of the investments and expenses, which can help him/her bring down the taxable income, and hence the TDS is deducted in excess. In such cases, the additional tax, which is paid, can be claimed back as the tax refund. This can be done only after the taxpayer files the tax returns. If you have filed your ITR, the tax refund becomes due.

How much refund is due?

Whenever a taxpayer claims the refund in the return of income, the Income Tax department processes the request. The taxpayer receives an intimation under section 143 (1), which also confirms the quantum of refund, which is due. The intimated amount can either match or be higher or lower than what was originally claimed. This amount is processed by the income tax department.

Interest on the income tax refund due

Under section 244A of the Income Tax Act of 1961, the government has to pay interest, if the income tax refund amount surpasses the 10% of total income tax paid. You will be eligible for an interest rate of 0.5 per cent each month on the due refund amount. The interest will accumulate from the first day of the assessment year until the date when the refund is granted.

How is the refund payment processed?

Normally, the refund amount is processed directly into the bank account of the taxpayer. The bank account details are based on the details which are furnished by the taxpayer while filing the income tax returns. Besides a direct transaction into the account, the refund can also be paid to the tax player via cheque. This happens when the bank account details are not clear. The refund check is issued against the account number mentioned in the returns.

How to check the status of income tax refund?

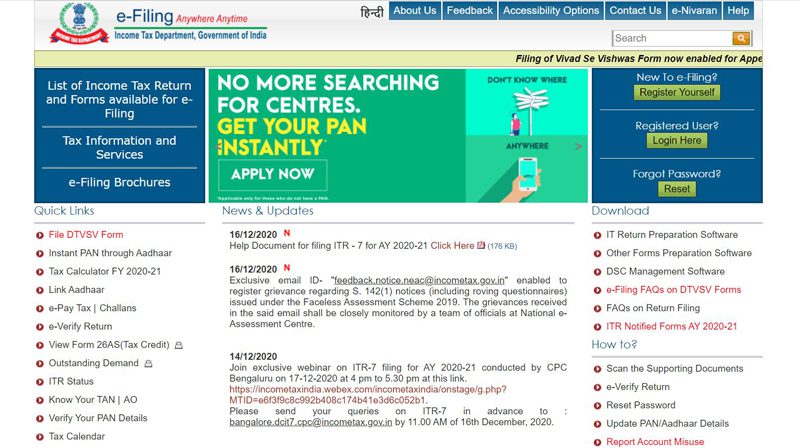

Screen grab of the Income Tax e-filing portal

Once the taxpayer has filed the ITR and claimed the refund, the status of the same can be tracked online. There are two websites which facilitate online tracking. You can either log into the official e-filing website or the NDSL portal. Once logged in, click on the ‘status of tax refund’ tab. You will be asked to enter the PAN, along with the AY (assessment year), to proceed further.

Tracking status via e-filing website

You can start by visiting the e-filing website. Proceed further by logging into the account using your ID, password, and date of birth. Once you are in your account, go to ‘My Account’ and click on the ‘Refund/demand Status’. Choose ‘Income Tax Returns’ from the dropdown and click on submit. Click on acknowledgement number and a page along with the complete details and status of your ITR filing will display on the screen.

Tracking status via NSDL website

This process is similar to the one mentioned above. You need to visit the NSDL website and log in using your credentials, including your PAN. Proceed to select the relevant AY, enter the captcha and click on submit. If the refund is already processed, the screen will display information mentioning mode of payment, status and date of refund, along with a reference number. For any further clarification or assistance, you can reach out the Income Tax support via phone.