For any country, duties extracted from the import and export of goods form a major part of its revenue. The process not only helps boost the country’s economy but also assists in regulating and facilitating international trade developments. A similar story can be described of the UAE Customs Department, which is responsible for enforcing customs laws and regulations within the country.

Featuring a number of branches and offices throughout the country, the UAE Customs Department forms a vital section of the UAE economy by protecting the country’s borders, collecting revenue from the government, and facilitating the movement of goods via customs. The organisation has also implemented a number of specialised units, such as the Anti-Smuggling Unit, the Trade Facilitation Unit, and the Intellectual Property Rights Unit, ultimately improving its effectiveness and efficiency. So, if you are arriving in or departing from the UAE and are carrying goods that have to be declared to UAE Customs, then our extensive guide can help you navigate through the same.

Steps For Paying Custom Clearance Fee

According to the rules laid down by the UAE Customs Department, passengers arriving in or departing from the UAE and carrying financial instruments, cash, valuable stones, precious metals, or equivalent amounts in other currencies in excess of AED 60,000 must declare the same to the customs authorities beforehand. And for passengers who are less than 18 years of age, the amount in their possession will be added to the total permitted limit of their companion, guardian, or parent.

Currently, the rate of customs duty is 5 per cent of the value of goods, along with their requisite cost, freight, and insurance. And the amount is 50 per cent for alcohol and 100 per cent for cigarettes. To start the declaration process right away, please follow the suggested steps mentioned below.

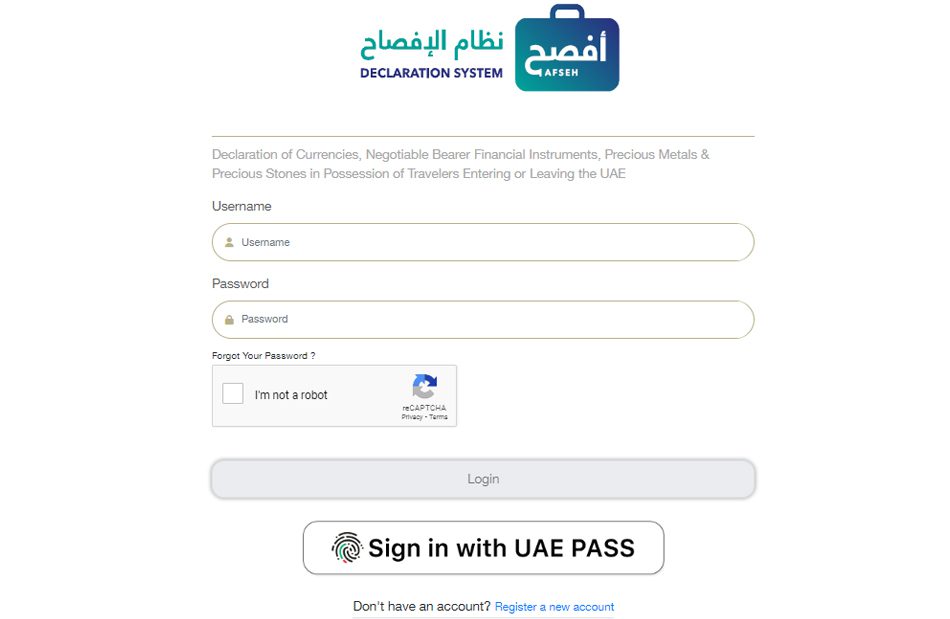

- Begin the process by first visiting the official website here. Additionally, you can also download the AFSEH app by the Federal Customs Authority, either from the Google Play Store or the Apple App Store.

- On the landing page, proceed to sign in with your existing username and password. If you do not have an account, then you can create one either using your email ID or your UAE Pass.

- Once done, you will be required to declare the value of the goods that you are carrying – whether you are arriving in or departing from the UAE.

- If the value of the goods exceeds the permissible limit, you will be required to pay the requisite customs duty.

- After successful payment of customs duty, proceed to take a printout of the receipt for future reference.

Please note that payment options include debit cards and credit cards from major international vendors, such as MasterCard, Visa, Discover, and American Express.

Documents Required and Other Related Information

Once you have paid your customs duty upon declaration of your goods via the above-mentioned process, all you need to do is present the receipt or e-receipt as proof of payment when stopped for checks at customs clearance checkpoints within any airport premises in the UAE.

But, before you decide to pay customs duty for the goods that you will be carrying, it is essential to learn the different items that are exempted from customs and the ones that are banned or restricted. Starting off, the items that are exempted from customs duties include: telescopes, cell phones, movie projection devices with accessories, radio and CD players, strollers, TV and receiver (one each), video and digital cameras (with tapes for personal use), calculators, portable music instruments, portable computers and printers, wheelchairs, personal sports equipment, medication for personal use, personal jewellery, and clothes and luggage (including toiletries for personal use).

Additionally, the value of luggage, gifts, and perfumes should not exceed AED 3,000 and must be in limited quantities. Also, the passenger must not be a frequent traveller with goods or a member of a conveyance crew. Lastly, a total of 200 cigarettes, 50 cigars, or 500 grammes of tobacco, and up to 4 litres of alcoholic beverage or 2 cartons of beer (containing a total of 24 cans not exceeding 355 ml for each can) will be exempt. Values and quantities in excess of the ones mentioned above will be charged for customs duty (in addition to VAT or Value Added Tax).

Apart from that, when it comes to banned items, they include: drugs and narcotic substances; counterfeit currency; gambling tools and machines; pirated content; items used in witchcraft or black magic; and artwork and publications that challenge Islamic workings and teachings. In addition to that, restricted items include: nuclear energy products, weapons and ammunition, live animals and fertilisers, media publications and products, medicines and medical tools, alcoholic drinks, new vehicle tyres, cosmetics and personal care products, wireless and transmission devices, and e-cigarettes and electronic hookah.

To learn more about UAE customs, visit here.

How Much Time Does the Clearance Take?

If you declare your goods (whose value exceeds AED 60,000) to the UAE Customs Department before your arrival in or departure from the country and also showcase your receipt or e-receipt for the payment of the customs duty, then you can expect automatic clearance from the authorities immediately without delay.