The most profitable and well-capitalized bank in Southeast Asia, UOB, or United Overseas Bank, is recognized for its efforts to promote banking and other sustainable business practices. Being consistently ranked as one of the world’s top banks by credit agencies such as Fitch Ratings, Moody’s, and Standard & Poor’s, UOB has always been committed to providing seamless financial services to its customers, both in the consumer and corporate sector. And with a global network of more than 500 branches across North America, Asia Pacific, and Europe, it is evident that the institution is well-placed to help its clients reach their financial goals.

Having said that, the actual user experience with United Overseas Bank might not be the most straightforward, with customers complaining about high fees and charges on ATM withdrawals and exceeding credit card limits, sub-par customer service relating to unhelpful staff, and facing difficulty when using their online products and services. And even though the bank has a formal complaints process in place for customers to vent their frustrations, not everyone has the patience or time to deal with it. If you are one of them who is routinely frustrated due to any of the aforementioned issues, then this guide can assist you in closing your UOB account swiftly.

What are the Steps to Close Your Account

At the time of this writing, the account closure process can only be completed by visiting a nearby branch. Keep in mind that when you are visiting the bank branch, be sure to carry your bank-related as well as original personal documents for verification purposes. Additionally, for joint account holders, all the account holders must be present at the bank branch during the account closure process.

To start the account closure process follow the recommended steps provided below.

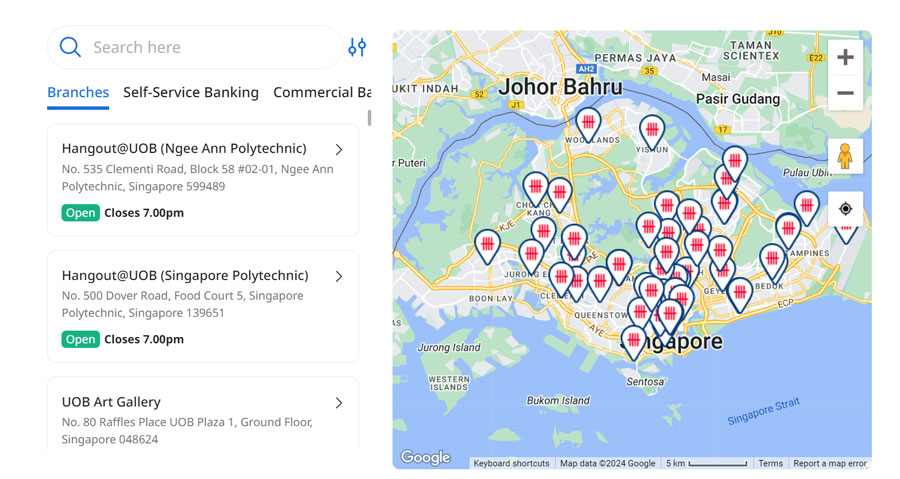

- First, you need to located a nearby UOB branch in Singapore. To find one, visit the official website here.

- Choose your preferred branch and head over there with your relevant set of supporting documents.

- At the bank branch, fill out the account closure form and submit the same. In addition to that, you also need to attach or showcase any supporting documents to streamline the process.

- Once done, wait for the bank’s customer support to complete your request so that your bank account is terminated or closed on the spot.

- A confirmation message will also be sent to your bank’s registered email address, letting you know about the successful closure.

Before you close your UOB bank account, remember to transfer any remaining funds to another bank account of your choice. And if you have any recurring payments linked to your bank account, do not forget to re-link with another bank account of yours, because they will be canceled subsequently. Finally, destroy any outstanding checks payable via your bank account.

How to Register a Complaint

For any general enquirers on banking, credit cards, or any other services provided by United Overseas Bank, you can get in touch with the customer care at 1800 222 2121. And if you have any suggestions or complaints that you want to share, you can contact the bank staff via the same phone number. Alternatively, you can submit the feedback or complaint form online as well.

Lastly, you can write to the bank’s customer support via physical mail at the following address: United Overseas Bank, Robinson Road, PO Box 1688, Singapore 903338.

An Overview of the Products

United Overseas Bank offers a comprehensive range of exceptional products and services that are ideally designed to meet the needs of individuals, businesses, and institutions alike. Its global network of branches and offices allows users to access their services anywhere in the world. And with a deep understanding of the Singaporean financial market, tailored financial solutions can be offered without any hassle.

Starting with personal banking, UOB offers a wide array of solutions to help customers reach their desired financial objectives. From offering savings accounts at competitive interest rates to providing digital banking solutions, UOB ensures that every user can experience a seamless and rewarding banking experience. Its credit cards are also configured to provide exciting benefits and rewards, from earning cashback on daily expenses to earning exclusive privileges for various dining and travel activities.

In addition to that, personal financial services also include providing loans (home, personal, vehicle, educational, etc.), insurance plans, and investment products and/or services (stocks and shares, bonds, mutual funds, etc.).

When it comes to businesses, UOB similarly offers a wide set of financial tools and solutions. From corporate financing options to cash management services, the institution properly understands the unique challenges that most startups and businesses face in today’s dynamic market. Apart from business banking, it also provides institutional banking services such as private banking, asset management, and venture capital management.

Additionally, the aforementioned core banking services are further complemented by a range of other essential products and services, such as wealth management, trade finance, treasury services, foreign exchange services, cash management services, payroll services, and visa and passport services.