Founded in 1864, Travelers has been around for more than 150 years, which also makes it one of the oldest insurance companies to shop with. Travelers is also one of the largest and top-performing providers in the US. It is best known for its propensity to innovate and incorporate user-friendly features and tools on its website and mobile app. They started off with standard insurance but eventually grew to offer auto insurance, business, and homeowners besides others.

Travelers is highly-regarded by industry experts and offers a broad spectrum of coverage solutions. They always try to be ahead in checkpoints to help you with the best insurance solutions. Travelers undoubtedly has a rich working culture where employees have more willingness to help distressed customers.

Good student and new driver policy discounts at Travelers make it a sensible choice for car insurance for teens. An A++ financial strength rating from AM Best, easy car insurance quotes process, and new car replacement coverage are some of Travelers’ strongest points to consider.

Travelers is neither the cheapest nor the most expensive market compared to its competitors. While comparing coverage rates remember to bear in mind that multiple factors affect product pricing.

Amongst a jillion of discounts, it pays to take a look at the most interesting ones at Travelers — The Homeowners Discount even if your house or condo is insured with a different company, up to 5%; Discount for having no gaps in coverage up to 15%; Discount for getting a quote before your policy expires 3-10%; and, Affinity group discounts for being a member of certain organizations.

Some of the other discounts at Travelers include — multi-policy discount, multi-car discount, safe driver discount, hybrid/electric vehicle discount, good student discount, driver training discount and good payer discount.

Apart from auto insurance coverage, Travelers offers insurance against the following products — Homeowners Insurance, Renters Insurance, Condo Insurance, Personal Property Coverage, Landlord Insurance, Jewelry and Valuable Items Coverage and Wedding/Events Insurance.

If you are a Travelers insurance holder and are looking for ways to submit a claim, keep reading.

1. Go Online and Submit a Claim Instantly

If you must navigate seamlessly through the entire claims process at Travelers, click here. You will get all information relevant to filing claims, uploading files and pictures, managing and tracking your claim’s status, and a reliable messaging system that enables you to connect effortlessly with a claims professional.

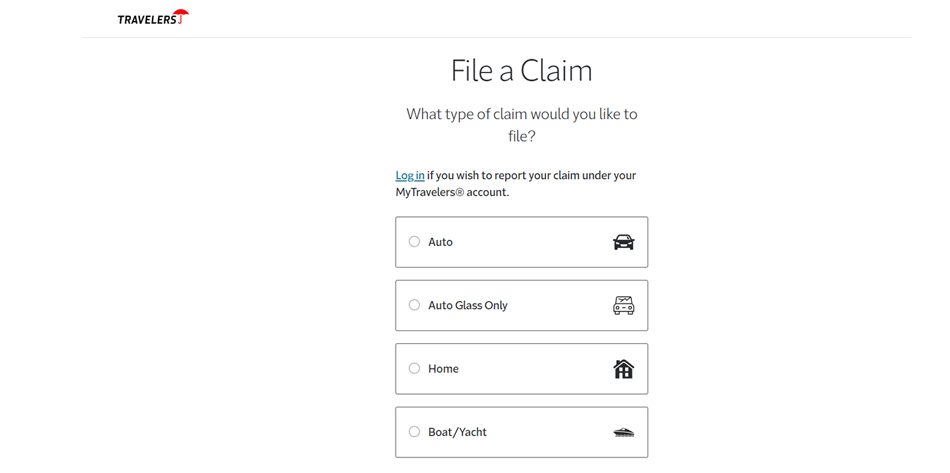

To file a claim online, simply visit this link. Travelers is high on digital experience and has robust toolkits in place that make it easier to manage your claim experience through their innovative digital claim solutions. The process is smooth and efficient and has been designed to make reporting claims a stress-free experience in toto.

You will be contacted by a claims professional soon after you are done with filing an online claim. In the meantime, you can take steps to prevent further damage to your property (which could be a vehicle, house, personal belongings, etc). It helps to have a Travelers account to track progress of your claim; if you do not already have one, you can create one. Collect pertinent details of the incident and take clear pictures of the damaged portions of your property or vehicle so that you can share them with your claims professional eventually.

The claims expert will keep you updated throughout while they work to collect additional information to review the situation, study the terms of your policy, meet with others involved in the accident, and evaluate your loss by correlating the facts with the documents you sent them. They may or may not arrange for an in-person meeting with you before they prepare their final report and initiate your payment. Payments are either made in checks and sent through the regular mail, or the money could be deposited directly in your bank via their ePay options.

2. Call the Dedicated Number for Claim

You can get 24×7 phone assistance at Travelers as it is committed to the highest level of service to its customers. To report an auto, home, or personal property claim, you may call at 800-252- 4633. Travelers representatives are available at all hours of the day and night, 365 days in the year so you will almost invariably get a chance to speak with an agent who will be able to guide you through the claims process.

You can call on the same number to speak with someone to learn about the updates on your claim. Claim professionals are available between 8 am and 5 pm, Mondays through Fridays. Alternatively, you can track your claim online.

3. Drive to the Nearest Branch

If you are not too fond of the digital tools and would rather take the traditional path of chatting up with a Travelers representative in person, you may use the Travelers locator to find an agency near you. Click on the link here and enter your city, state, and zip code to look for agents within 5, 10, 25, or 50 miles of distance from your place of residence. The locator should be able to throw up helpful search results to get things sorted for you.

Travelers plays a key-role as a go-between to recover your loss from the culpable individual/entity if you were not at fault. In such a scenario, it will also try to reimburse your deductibles but you will have to be patient as such things as negotiations with a third party are time-taking.