An household name in the United Kingdom, Direct Line is a company that is synonymous with home and car insurance. Established in 1988, courtesy of the UK’s insurance market deregulation, the enterprise created a direct sales model for insurance plans, effectively cutting out the ‘middleman’ and offering competitive rates. This innovative approach quickly resonated with consumers, and Direct Line rose in prominence, ultimately capturing a significant market share.

Over the years, Direct Line has continued to expand its portfolio beyond home and car insurance, venturing into life, travel, cycling, pet, business, and other insurance coverage plans. And to further solidify its existence, the company has carried out multiple mergers and acquisitions while continuing to be one of the leading insurance providers. With that being said, if you are a Direct Line insurance policyholder and want to submit a claim relating to an emergency, you can conveniently do so by following this comprehensive guide.

Steps to Submit Claim Online

If you are planning to submit a claim for your Direct Line insurance policy online, then you can do so by simply following the suggested steps provided below.

- Start the process by first visiting the official ‘Claims’ web page here.

- On the landing page, you will be presented with a number of insurance policy types to choose from. Select the type for which you want to submit your claim.

- Once you have selected your insurance type, you will then be redirected to a new page where the details of the claims process will be provided, along with the option to submit your claim online. For instance, if you have chosen ‘Travel’, then the subsequent page will show the ‘Start Your Claim Online’ option. Click on it.

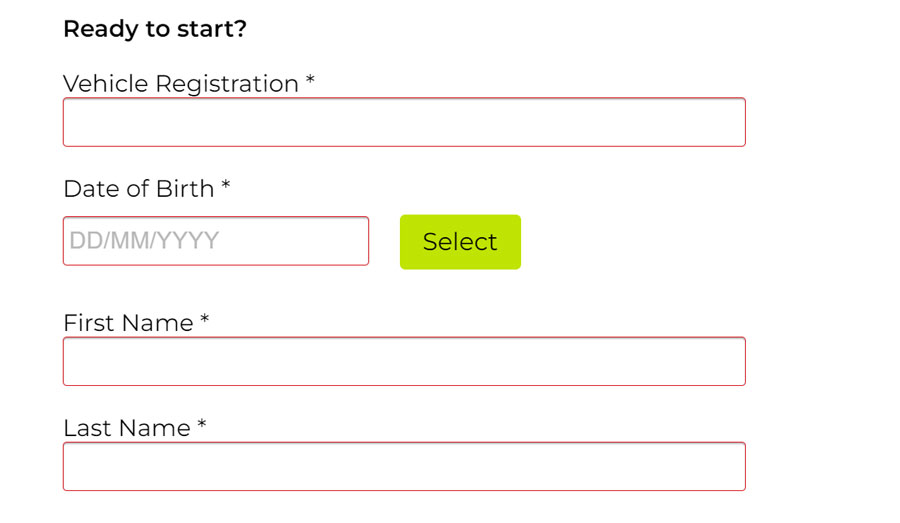

- You will then be asked to complete a series of steps in an online form to be able to submit your claim successfully.

- Start by first stating your policy number, your full name, date of birth, registered email address, postal code, and registered phone number. Once done, click on ‘Next’.

- After that, you need to provide details relating to the reason why you are making the claim. For instance, if you are submitting a claim for your travel insurance, then you need to state the details of your trip and the incidents that took place that led to you opting for the claim. You also need to provide any supporting documents, as required.

- Once done, proceed to submit your claim.

- After a successful submission, you need to wait for an official response from the company’s customer service.

Other Ways to Submit Claim

In addition to submitting your Direct Line insurance claim online, you can also complete the process over the phone simply by following the steps provided below.

- First, you need to head over to the official website here.

- Proceed to select the type of insurance you have. For instance, if you want to submit a claim for your home insurance, click on ‘Home’.

- A new page will open, where you need to scroll down and reach the section ‘Ready To Claim?’.

- Under that section, click on the option to talk to the company’s claims team, and a pop-up window will open showcasing the relevant phone number and working hours. Keep in mind that the contact number for each claims department will be different, so make sure you use the proper information.

- Once you gather the phone number, proceed to make a call and talk to the customer care representative. Provide your policy details and the incidents that took place, ultimately forcing you to submit the claim.

- After submitting your claim, you will be asked to wait for an official response from the company’s claim handlers so that the approval process can be completed.

Overview of Products

Direct Line is a British insurance company, offering a wide variety of insurance products and services to individuals and businesses across the United Kingdom. With the insurance arm of the entity, you get access to car and home insurance policies. From offering comprehensive coverage such as breakdown cover for cars to accidental damage or personal belongings cover for homes, you can expect to enjoy peace of mind. Direct Line also sells pet insurance policies for cats, dogs, hamsters, and rabbits – from accident-only coverage to lifetime coverage.

In addition to the above-mentioned insurance plans, Direct Line offers travel insurance for single trips or multi-trips, including medical expenses cover, cancellation cover, and lost luggage cover. On the other hand, life insurance plans include whole life insurance and critical illnesses.

Besides selling insurance policies, Direct Line also offers personal loans to individuals, mortgages ranging from fixed-rate to variable-rate, and savings accounts. With their easy-access savings accounts, ISAs (Individual Savings Accounts), and notice savings accounts, you can start preparing for your retirement.