Nowadays, over-reliance on digital transactions has introduced to world various online scams and frauds. From receiving inflated credit card bills to people falling for phishing scams, maintaining online security is more essential today than it has been ever before. Adding to the misery is the excessive use of credit cards for online transactions including shopping. And since credit cards work differently than debit cards while also providing better advantages, card fraud is more common to happen.

What works in a credit card’s favor is the ‘dispute’ or ‘charge-back’ system, where credit card holders can claim back the money they spent on a transaction – provided that the reason behind it is genuine. So, if you see that strange transaction in your credit card statement or did not receive the product/service you paid for, then you have a way to get your money. And to do that, we have rounded up a comprehensive guide for OCBC customers who want to file a credit card dispute seamlessly. Read on to find out more.

All Your Options to Dispute Charge

OCBC Singapore allows its customers to dispute a transaction either through the bank’s mobile app or on the desktop via your computer. By using the ‘dispute transaction’ process, you will be able to file a claim on transactions that you were not liable for or made by you. Additionally, if your credit card is stolen or lost, and unauthorized transactions have popped up in your credit card statement, then you can use this process as well.

The terms and conditions state that if you spot any unauthorized transaction on your credit card statement, be sure to report the same within 7 days of receiving the statement or receiving the balance deduction SMS on your registered mobile phone number. The ‘dispute transaction’ system also protects you from billing errors and from merchants who fail to deliver or deliver defective/unsatisfactory products/services.

Keep in mind that the dispute process involves providing relevant information and supporting documents by the customer so that the bank officials can assist you in getting your money back. Also, remember that you can dispute up to 35 Visa transactions and 15 transactions in a single go. However, no dispute rights will be provided for transactions that have been fully authenticated, such as via an OTP (One-Time Password). Lastly, be sure to know that all decisions will be subject to the sole discretion of the card association.

With the rules and regulations out of the way, be sure to follow the recommended steps provided below for raising a credit card charge-back request.

Disputing Transaction via App

- Start by first downloading the OCBC banking app on your smartphone. If you have an Android device, visit the Google Play Store, and if you have an iOS device, then visit the Apple App Store.

- Once downloaded, sign in to your account using your customer ID and password. After that, select ‘Card Services’ and then click on the ‘Dispute Transaction’ option.

- In the next step, select the transaction that you want to dispute and confirm the same by selecting either ‘Yes’ or ‘No’.

- Once done, choose your reason for disputing your transaction and then finally confirm your choice by submitting the same. Once done, wait for a follow-up message from the bank’s customer support.

Disputing Transaction via Internet Banking

- Begin your journey by visiting the official website for OCBC internet banking here. Sign in with your access code and PIN.

- Once signed in, select ‘Cards > Dispute Credit Card Transaction’.

- After that, look for the transaction that you wish to dispute and then proceed to select that. Confirm your choice by selecting ‘Yes’ or ‘No’.

- Finally, choose the reason for your dispute and then submit the same for verification. Expect to receive a follow-up message in your email address from the bank’s customer care.

What are Other Ways to Dispute

If you are not accustomed to raising your credit card transaction dispute online, then you can do so by submitting the dispute form offline at an OCBC branch near you by following the suggested steps below.

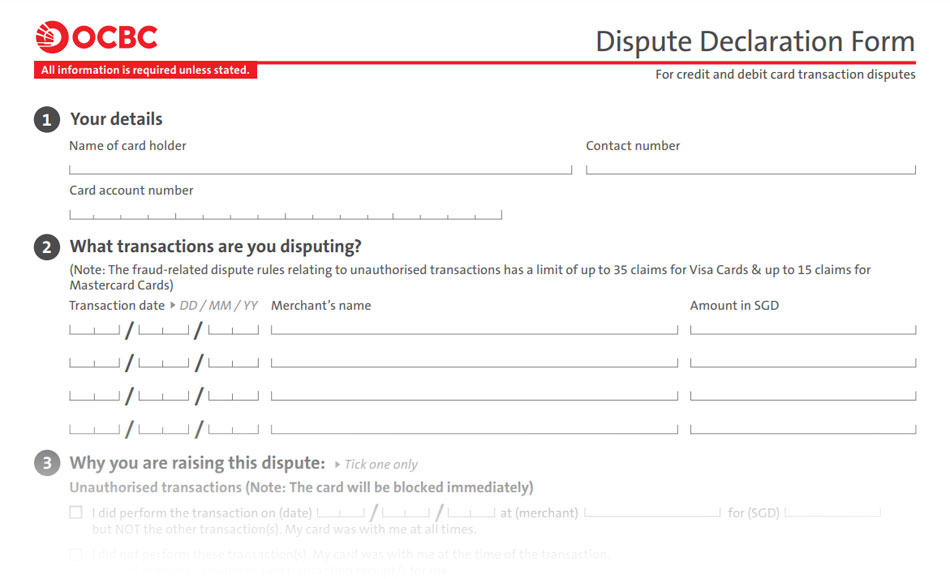

- Kick-start by first downloading the credit card ‘Dispute Declaration Form’ here.

- Once done, print the same and fill it out.

- After filling out, proceed to submit the same to a nearby OCBC branch. To find an OCBC branch, visit here.

- Once submitted, wait for a follow-up response from the bank’s customer support.

Ways to Register a Complaint

If you are looking for additional assistance or a way to register complaints, you can easily do so by several communication methods. The first one involves calling the bank’s customer support at 6363 3333 or +65 6363 3333 (when calling from overseas). Additionally, you can also get in touch with OCBC’s ‘Card Fraud Management’ department at 6535 7677 or +65 6535 7677 (overseas callers).

Besides contacting via phone, you can also email the bank’s customer support using the official link here. And lastly, you can write a physical letter stating your complaint to the head office.