Navigating the nuances of the US tax system isn’t exactly a cakewalk. Filing a tax refund within the stipulated window ensures you do not miss out on the tax refund that the government owes you. However, did you know that getting a huge tax refund may not always be a good thing? Also, if you are a student or a parent, you might be missing out on certain tax credit claims!

Keep reading this article to find out if you should be filling out an income tax refund and how you can go about it.

Who is Eligible for a Tax Refund?

- You overpaid your taxes – If you overpaid your taxes the previous year, then you can claim the excess amount paid through a tax refund. You can avoid this by accurately filling out the W-4 form. This is the scenario where getting a huge refund isn’t a good thing since in essence, the government is merely paying you back an interest-free loan.

- Child Tax Credit- Though it’s been around since 1997, US president Joe Biden recently signed the American Rescue Plan which expanded the scope of the Child Tax Credit to provide $3000 – $3600 to families with dependant children.

- Earned Income Tax Credit- It is also popularly known as the Working Americans Credit and aims to supplement the income of low-income households. Earned Income Tax Credit helps to ensure good quality of living, especially in low-income households with children.

- American Opportunity Tax Credit – Aimed to help full-time and part-time college students, it can help reduce college education fees by up to $2500 each year. To be eligible, your Modified Adjusted Gross Income has to be less than $90,000 if single or less than $180,000 if married and filing jointly.

- Premium Tax Credit – It helps to lower the burden of paying high health insurance premiums. The amount to be claimed under this tax credit depends on various factors such as age, size of the household, and location.

In the US, as a tax payer, the tax refund is processed after you file your tax return. Many a times, even if you are not obliged to file a tax return, it is a good idea to do so, because it will enable you to claim any tax credit that you are eligible for. To effectively understand how much tax refund you are owed, you can check box two of your W-2 form. Do keep in mind that you need to file the tax refund before the completion of three years from the initial deadline. With that in mind, let’s explore the different ways to claim your tax refund.

1. File Your Tax Refund Electronically

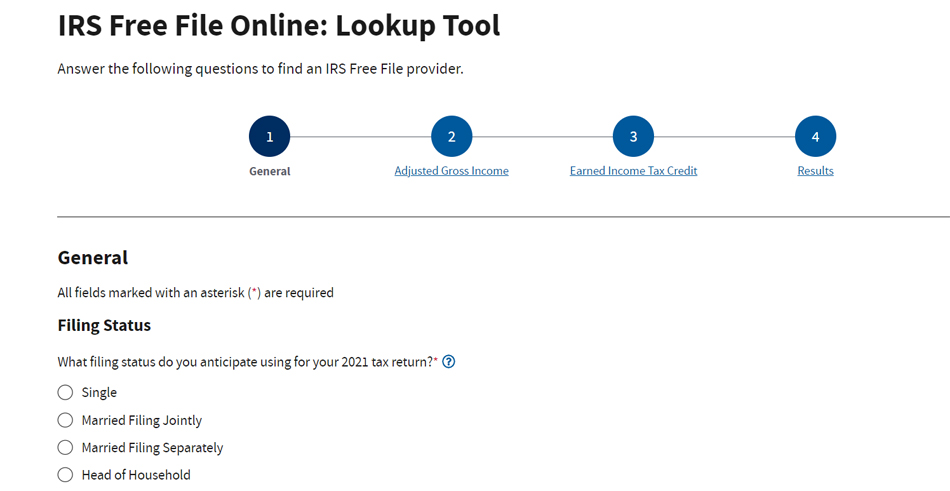

IRS provides different options to file your tax returns digitally. In fact, due to understaffing issues, taxpayers are being encouraged to file taxes digitally. If your Adjusted Gross Income is $ 73,000 or less, you can use IRS Free File. It is a tax preparation software that is available free of cost on the IRS website. It is based on a public-private partnership program and simplifies the process of filing tax return.

You can also file your tax return by yourself using a commercial tax preparation software. It is then transmitted through an IRS-approved channel to ensure security. In this method, you have to use the self-select pin enabled for electronic filing, or the Adjusted Gross income of the previous year to sign in. E-file is one such commercial tax preparation software and it offers free tax return filing to those who qualify for the software’s basic version.

Electronic tax return filing is also facilitated through IRS authorized E-file providers. The interactive search feature on the IRS website enables you to find authorized E-file providers based on your state and zip code.

2. Through VITA, TCE & AARP Tax Aides

IRS also offers two programs to assist a select group of individuals in filing tax returns – the Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs. Taxpayers with an annual income of $58,000, those with disabilities, individuals with a limited grasp of English, and senior citizens above 60 years of age can avail the benefits of these programs. Qualified individuals can find a VITA or CTE center in the nearby library, shopping mall, or other community centers. You can also browse the VITA locator here or call 888-227-7669.

Alternatively, one can also use the AARP Foundation Tax-Aide Locator to find a volunteer in one’s location, who shall assist eligible taxpayers in online tax return filing.

3. Mail the Tax Return

IRS offers you the option to download the tax return form from their website and then mail it to the address given for your state, using select private delivery services. However, IRS is discouraging taxpayers from mailing since it can take up to 6 months to receive your tax refund when mailed. To mail your tax return, simply print out the relevant forms -1040, 1040-SR, 1040-ES, and 1040-V, as applicable, from the IRS website, fill it out and mail it to the address for your state, from the list given on the IRS website.

You also have the choice of receiving the tax refund as a check, to the address given on the tax return form, or as a direct deposit to your bank account. Direct deposit is much quicker and provides the option to deposit your refund in up to three different accounts. On average, direct deposits take less than 21 days to be processed. Additionally, you can also use the tax refund to purchase savings bonds, by filling out form 8888 while filing a paper return.

You can check the status of your tax refund using the IRS2Go app, visiting the IRS website, or calling 800-829-1954. Ensure that you wait at least 6 months in the case of paper returns and 21 days if you e-filed, before contacting IRS regarding the refund status.