Online scams are as much a reality today as are online businesses. Ever since the advent of e-commerce in the 1990s, scams have been plaguing the users, and the threat is increasing with each passing year.

Facebook is a convenient social media platform that allows you not only to connect with long-lost friends, but also with strangers with whom you can strike business deals online. Digital experience offers vast opportunities to extend one’s reach globally and shed limitations of geographical boundaries. Distances are getting overlapped and narrowed down with every technological advancement and use of sophisticated tools.

Ironically, however, there is a downside to every promising trend. Fraudulent identities are increasing concomitantly much to everyone’s (the company, the consumer, and the law enforcement authorities) chagrin and helplessness. The perpetrators always seem to be ahead of the curve foiling every attempt by the legal authorities to rein them in.

Online shopping experience has become ‘the’ thing as it does not require you to leave the comforts of your home and waste gas to travel to a destination to buy your stuff. Facebook Marketplace is a popular platform that has made the buying experience rather hassle-free. It is the go-to place for consumers to buy almost everything under the sky — from couture shopping to antiques, cars, electronic devices, rentals, apartments, and so many more. It is a peer-to-peer marketplace that brings buyers and sellers under one umbrella, has listed products and services from multiple vendors resulting in wide catalog selection. The problem is that it is littered with scammers right now.

Types of Scams & Red Flags to Watch Out For

- When sellers (or prospective ones) ask for payments through untraceable methods such as cryptocurrencies or gift cards. Such payment methods leave no record of messages, and the crime can never get established.

- When sellers ask for advance and quick payments even before they mail their items to the buyers. Why would they ship an item when they live around the bend? Think about it. Do not fall for the trap. Insist on meeting up physically before clinching any deal. Remember to meet them in broad daylight, in a public place, and preferably with a backup like a friend or relative.

- Look out for buyers who are paying over and above the price quoted. A check payment would typically bounce. The thief needs to file a fraudulent charge request with their bank to have the charge reversed while you are left in the lurch. Do not refund the overpayment electronically, ask them to take it up with the bank.

- Fake profiles are flooding the Marketplace and there are many counterfeit items doing the rounds. Look for seller reviews and stay away from no-reviews and/or terrible ones.

- Do not fall for bargains that seem too good to be true (especially for high-ticket items). It probably is. You will do well to stick with realistic purchase prices.

- Do not engage in conversations with people with cryptic messages, little or no product descriptions, and no profile photos.

Now what if you do fall for the bait and get scammed? No matter what your primeval response is, it serves to keep your cool. We list the top 4 ways to report a Facebook Marketplace scam.

1) Report the Buyer or Seller to Facebook

The first and foremost action required when you fall victim to a Facebook Marketplace scam is to report the seller or buyer. Facebook has a team in place to monitor such cases and provide a resolve. Follow these steps to report a seller on Marketplace. Visit the listing of the seller you want to report and click on the name. You will see the option to “Report Seller”. If you want to report a buyer, navigate to the listing you had created. You will be able to see the message between you and buyer. Here, you will find the option to “Report Buyer”.

Unauthorized charges on your credit cards, missing funds from your bank account, calls from debt collectors, fall in your credit card scores, and realizing that your online account has been hacked could necessitate your going to the police. But in most cases, approaching the police should not be your first priority unless you know who committed the crime, you have information that could aid in the police investigation, your identity was used for criminal purposes, or your bank requires a police report for identity theft.

2) Contact Local Law Enforcement Agents

You must enlist the help and support of the local police department when you fall victim to such scams, and your personal identity information is compromised. Notify them immediately, and file a case report. If there’s a long lapse between the crime and reporting, it could further harm your financial reputation. However, not all situations will require filing a police report.

Before you approach the police, you could also notify the FTC. If and when you approach the police you should have the following documents with you — the FTC Identity Theft Report, personal identifying documents with evidence of the identity theft. Moving forward, you might have to change all your passwords, inform the credit bureaus, freeze your credit cards, and cancel your bank account if you suspect that the fraudster could be up to something big and tamper with your identity.

3) Notify the Federal Trade Commission (FTC)

Hit this link to report fraud to FTC. As you click on the Report Now button, you will be directed to a page that asks for specific information that applies to your situation. Carefully read the instructions and check against the option that is most applicable. The FTC encourages users to report anything as long as they suspect it to be a fraud, scam, or bad business practice. Your proactive thinking could help the FTC and its law enforcement partners spot problems early. Choose options that best fit your problem and you can even choose to divulge only as much as you wish to share with the authorities.

Try and be as descriptive as you can about the incident; if there were financial transactions involved, the FTC would want to know the amount, and when you paid. Try to be as helpful in providing information about the individual or company you are reporting, like their name, contact details, etc. The Consumer Financial Protection Bureau handles issues related to debt collection, credit card companies, credit reporting, and banking. Do not panic if you are routed to the CFPB to file your report if the category of your complaint falls within the scope of their functions. Your report will still be in the FTC’s database and will be accessible to federal, state, and local law enforcement across the country.

You can reach the FTC’s Consumer Response Center at 877-382- 4357. Once your report is formally submitted, investigation opens and FTC shares your report with more than 3000 law enforcement partners. They try to book fraudsters, educate the public, and also get refunds for people who were duped.

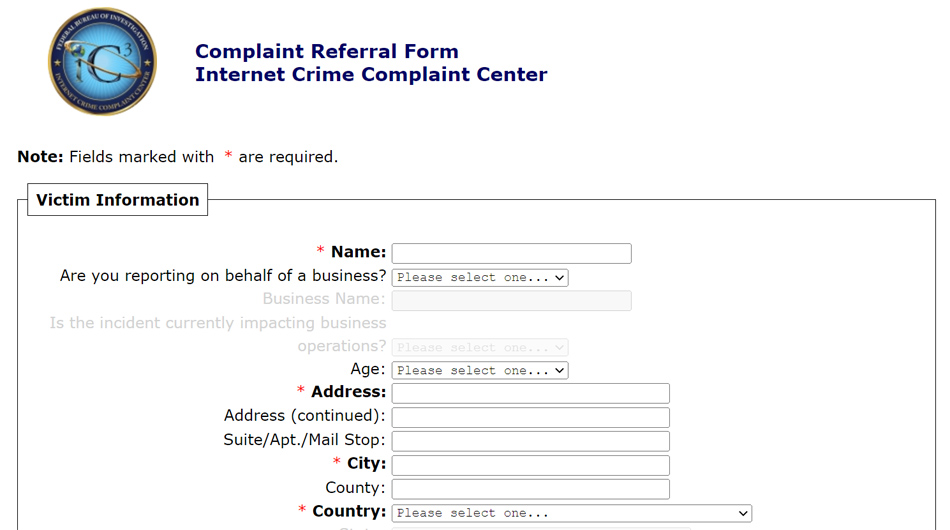

4) Reach Out to Internet Crime Complaint Center

Any form of internet crime can also be reported with the Internet Crime Complaint Center. Give complete and accurate information regarding the scam when you fill out the IC3 complaint form. They ask for the following details — your name, address, telephone number, and email ID; financial transaction information; the name, address, telephone number, email ID, and IP address of the individual or entity who committed the crime; descriptive details on how you were victimized; and any additional information that you believe can support your complaint. The following fall within the purview of internet crime but are not limited to — advance fee schemes, non-delivery of goods and services, computer hacking, etc.