While the COVID-19 pandemic is a thing of the past now, the e-commerce industry continues to grow worldwide. People are shopping online more than ever before, and with the holiday season coming, online retailers will be pushed to their limits. Another metric that has been on the rise over the years is the use of credit cards, as they make online shopping more seamless and hassle-free than ever before.

There is another reason why credit cards continue to gain popularity across the globe – and that is the buyer protection that they provide – compared to usual debit cards. Such is the reason why credit card chargebacks and disputes have been ever-increasing, so much so that the reports in 2022 suggested that the Visa network received more than 90 million disputes in a single financial year. Disputes or chargebacks are usually applied when the buyer is no longer happy or satisfied with the products/services that they have purchased. And if you are one of them, then our insightful guide can help you claim your money back swiftly.

What are the Steps to Dispute Charge

According to Westpac’s terms, you will be able to recover funds for goods and services that you have paid for – in the event that you do not come to an agreement with the merchant directly. For this, you need to contact the merchant and attempt to resolve the matter before lodging the dispute claim.

Once you raise a dispute regarding the relevant transaction, Westpac will issue a chargeback against the merchant and will use your supporting evidence. However, there can be times when the merchant may challenge the chargeback, which is why a successful end result is not guaranteed.

There are many reasons why you may dispute a specific transaction on your credit card, and some of the popular ones include: goods or services not received; goods or services received defectively or not as described; recurring payments not cancelled; discrepancies in the amount of payment charged by the merchant; and duplicate transactions. To start the claim process, follow the recommended steps mentioned below.

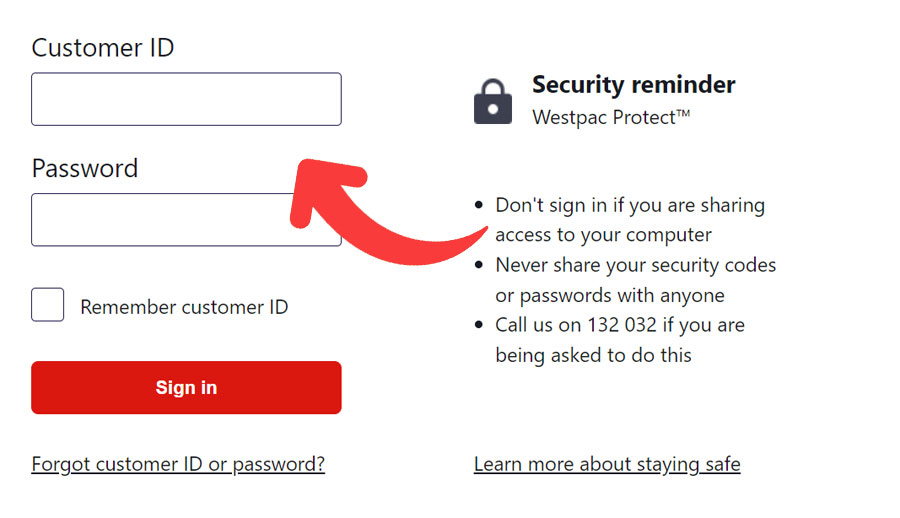

- Begin your journey by signing into your Westpac internet or mobile banking account here.

- Once signed in, head over to your pass transactions and look for the transaction that you want to dispute.

- After you have found your preferred transaction, select the ‘Dispute Transaction’ button beside it to start the process.

- A confirmation message will be sent to you via email or text message on your registered mail ID or phone number, containing a unique ‘Dispute Reference Number’.

Additionally, you can also submit the claim by getting in touch with Westpac’s customer support via phone at 1300 651 089. Phone lines are available between 8 AM and 8 PM local time, seven days a week. Otherwise, you can head over to your nearest branch as well. To locate a Westpac branch near you, visit the official website here.

Once you have initiated the dispute process, Westpac will act as a liaison between you and the merchant’s bank, which is why, in some instances, additional supporting documents or evidence will be asked to move forward with the process. And as always, you, as a customer, will be kept updated on the same.

Westpac states that when the dispute is in progress, a conditional dispute credit will be provided to your credit card. This is to ensure that you at least make payment for the minimum repayment amount to avoid charges, such as late payment fees. And the requisite interest on the disputed transaction will be simply paused during the process. Similarly, for part-payments, the repayments will be halted while the dispute process is ongoing, and based on the outcome of the process, the repayments will start again.

When the merchant challenges your dispute, the supporting documents will be sent to you via mobile or internet banking for you to review and respond to. If you are not registered via the internet or mobile banking, then the documents will be sent to your registered email ID. Once you receive the merchant-side supporting documents, you will have the option to either accept the merchant’s side of the story or further continue the dispute by providing additional evidence.

It should be known that if you accept the outcome that is provided by the merchant, then the provided conditional dispute credit will be subsequently reversed. However, if you decide to continue the dispute process, then a written reply must be provided via your email address as a reply to the documentation that you received. Once Westpac receives your written reply, the investigation will be further continued, and a decision will be reached.

Keep in mind that if the decision is guided in your favor, then the deducted funds will be credited to your account. Also, remember that you will have 15 days after receiving the merchant-side documentation to provide a written reply. If you do not, then your rights to dispute the transaction will be lost, and any conditional dispute credit provided will be reversed.

Lastly, expect a timeframe of 45 days (maximum) for your dispute process to be resolved.

How to Register a Complaint

If you want to share any feedback or register any complaint with Westpac, you can do so by heading over to the official website here.

Finally, if you want to report any unrecognized transaction or card fraud, you can contact the customer care via phone at 1300 364 294. Phone lines are open 24×7.