When it comes to property and auto insurance in Canada, Aviva is leading the pack with its wide range of insurance products. Well-reputed for its competitive rates, innovative products, and excellent customer service, the company is always committed to meeting the needs of its customers. Since its inception in 1999, Aviva has been one of the first in the insurance sector to offer online claims processing mechanisms. And its dedicated support works around the clock to ensure concerns are addressed in a timely manner.

Currently serving over 3 million customers, Aviva Canada has made its claim settlement process as smooth and hassle-free as possible. You can now make your claim either online or over the phone, without having to move a muscle. Additionally, if you have a trusted insurance broker, he or she can also help you file the insurance claim. Having said that, if you are looking for a detailed guide on how to proceed with the claim submission process, then this in-depth article is just for you.

Know the Steps to Submit Claim

If you are looking to submit your insurance claim online, then you can do so by following the recommended steps provided below.

- Start the process by first heading over to the official website here.

- On the home page, under the ‘Make A Claim’ option, select ‘Submit A Claim’.

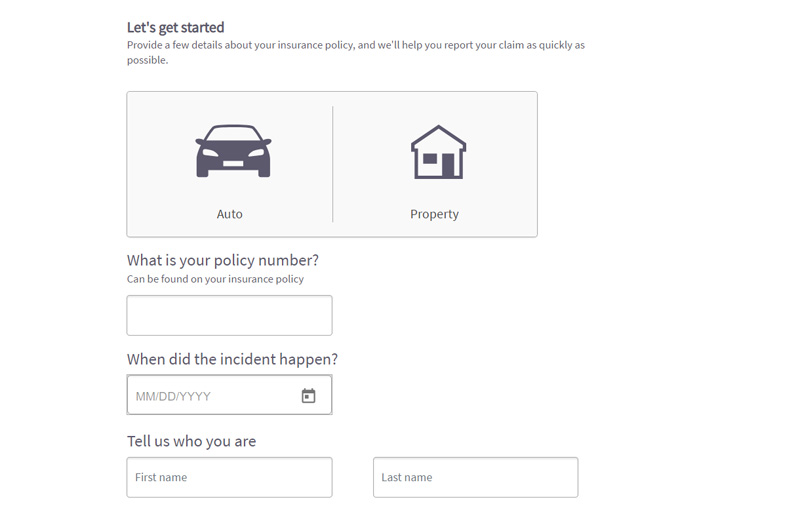

- You will be redirected to a new website, where you will need to select the category of the insurance claim that you are planning to submit. The given options will be either ‘auto’ or ‘property’.

- Once you have selected your insurance category, state your policy number.

- After that, choose the date when the incident took place (for which you are submitting the claim).

- Then, you need to state your full name as well as the postal code (as stated in your insurance policy).

- Once done, click on ‘Continue’ and proceed to add any additional details or information that you are asked to provide.

- After you have submitted your claim successfully, one of the company’s insurance claim experts will review the details of your claim settlement.

- Based on the size or type of your claim, the subsequent process can either be handled over the phone or an adjuster will be assigned to assess your claim.

- Once the final processes are completed, Aviva will arrange for the necessary funds for your claim to be settled so that you can get back to your normal lifestyle as quickly as possible.

What are the Other Ways to Submit Claim

In addition to the aforementioned process of submitting your insurance claim to Aviva Canada, you can also file your claim over the phone by following the suggested steps below judiciously.

- Begin your journey by first dialing Aviva Canada’s insurance claims department via phone at 1-866-MYAVIVA (1-866-692-8482). Phone lines are open 24×7.

- Navigate through the on-call options and proceed to speak to a customer care executive.

- Once a live agent connects to your call, provide your full name and policy number, and then state that you are planning to make an insurance claim.

- Provide all the necessary information related to your insurance policy, as asked by the customer care agent, so that your claim can be submitted successfully.

- After your claim is successfully submitted, the customer care representative will notify you of the same over the phone.

Overview of Products

Aviva Canada offers a comprehensive range of insurance policies for its customers, based on their needs and use-case scenarios. Starting with the company’s vehicle or auto insurance policies, you get access to numerous types of coverage – whether you are looking for collision coverage or optional roadside assistance. Aviva’s vehicle insurance plans cover the costs of damage or injuries you may cause to others in an accident, as well as the damages inflicted upon your own vehicle. And when it comes to optional coverage, they include damages inflicted due to fire, theft, or vandalism.

Talking about property insurance policies, Aviva Canada offers multiple options to safeguard your valuable home and its contents. Whether you are looking to protect the physical structure of your home, such as the foundation, roof, and walls, or your personal belongings, such as electronics and furniture, the company ensures that you are safeguarded from emergencies, ultimately providing you with peace of mind. Additional coverage includes liability coverage (for legal costs and medical expenses), especially if someone gets injured within your property premises, equipment breakdown coverage, and identity theft coverage.

Completing its portfolio of competitive insurance plans are the travel insurance policies offered by RBC Insurance. Acquired by Aviva Canada in 2016, RBC Insurance handles all types of travel insurance claims related to emergency medical situations during your travel trip, along with trip cancellations and interruptions, flight delays, baggage loss, and damage, and rental vehicle damages.

For any additional queries or assistance, you can also contact Aviva Canada customer support via phone at 1-800-387-4518 or 1-800-855-0511. Phone lines are open from Monday to Friday, 24×7.