Referred to as one of ‘The Big Four’ financial institutions in Australia, the National Australia Bank offers a wide range of private, personal, and business-related financial services, to customers residing in Australia and its neighboring country, New Zealand. Even though the bank was originally formed in 1982, its history dates back to the 1830s, since the institution was the result of a merger between the Commercial Banking Company of Sydney and the National Bank of Australasia. As of today, it has branches located across the globe, including in countries such as India, China, Japan, Singapore, the United Kingdom, and the United States.

In 2023, the National Australia Bank was crowned as one of the most profitable banks in its home country, netting a profit of more than $6 billion (as of 2022). The organization also plays a major role in supporting the Australian economy by introducing relevant programs that help promote financial education, literacy, and employment in Australia. But, there can be moments when even a well-run company can fail to live up to customer expectations, and if that is the case with you, then our extensive guide can help you close your National Australia Bank account right away.

Know the Steps to Close Your Account

National Australia Bank (NAB) states that the quickest and easiest way to close your account is by utilizing the ‘NAB Messaging’ service either via the NAB app on your smartphone or through the NAB Internet Banking services. But, before you proceed to do so, you need to be aware of the terms.

Firstly, your account balance must be nil (zero) before you register your request for account closure. So, if you have any remaining balance in your account, be sure to transfer the same to another bank account of yours. After that, you need to cancel any recurring payments and direct debits that have been previously set up in your account.

Once you have completed the above-mentioned actions, ensure that all your recent transactions have been successfully processed before registering your request for account closure. Remember that it can take up to a few business days for your transactions to change their status from ‘Pending’ to ‘Posted’. So, if you have any doubts, make sure to obtain the transaction details from the NAB app on your smartphone. And lastly, do not forget to present any outstanding cheques.

Now that you have a proper rundown of the rules and regulations, let us go through the steps you need to complete to register an account closure request.

Closing Account via NAB App

- Start by first downloading the NAB app on your smartphone, either from the Google Play Store on your Android device or the Apple App Store on your iPhone.

- Once downloaded, login to your account using your customer ID and password.

- After signing in, click on the ‘Accounts > Chat’ option present on the right-hand corner of your screen. Doing so will launch a secure chat on your smartphone.

- In that chatbox, type ‘Close Account,’ and then click on ‘Chat To A Specialist’. After that, you will be connected with a bank representative who will help you to close your account.

- Once your account is successfully closed, you will receive a confirmation message on your email address.

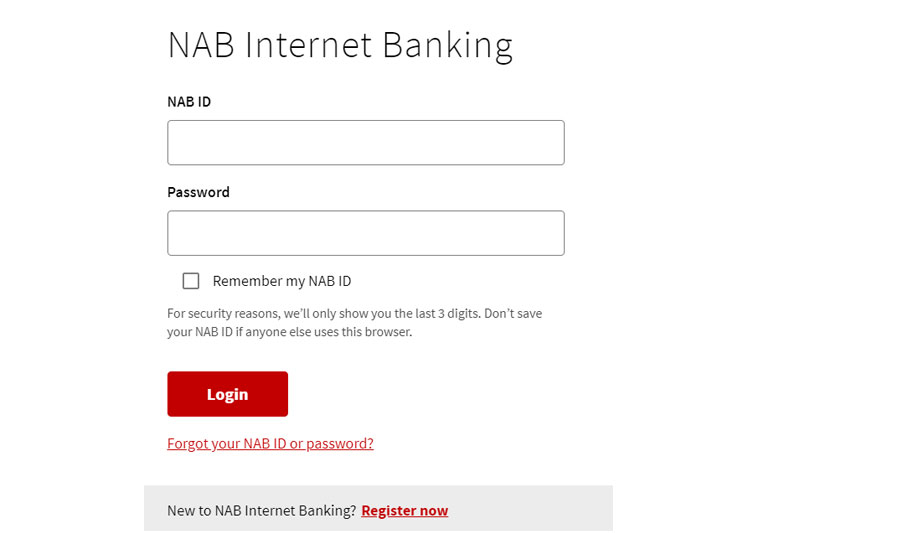

Close Account via NAB Internet Banking

- Begin by logging into your NAB Internet Banking account by visiting the official website here.

- After signing into your account, click on the ‘Chat’ option present in the bottom right-hand corner of your screen. This will launch the website’s secure chat option.

- Once done, type ‘Close Account’ in the chatbox, followed by ‘Chat To A Specialist’. Doing so will connect you to a customer care executive.

- Present your bank account details to the customer care representative and ask for an account closure request.

- Once your account details are verified, your request will be registered. After your account is successfully closed, you will receive a confirmation message on your email ID.

Once you have successfully closed your NAB account, you will receive a final statement letting you know that your bank balance is zero and the account is closed. Additionally, do not forget to destroy any linked cards (debit cards or credit cards) to your bank account by simply cutting through the magnetic strip and security code on the back of your card.

Ways to Register a Complaint

The ideal way to register a complaint with the bank support staff would be via phone by calling 13 22 65 or +61 3 8641 9083 (if you are calling from overseas). Alternatively, you can also fill out the online feedback and complaints form here.

If neither of the above-mentioned options worked for you, then you can get in touch with the bank officials at your nearest National Australia Bank. To find an NAB branch near you, visit the official locator website here. All you have to do is choose your preferred location and head over there to talk to the bank staff face-to-face.