Popular for its iconic wildlife, South Africa features a rich history that dates back to the ancient world. Its diverse culture, influenced by different ethnic groups, has been instrumental in shaping its food, music, art, and dance. The country is home to a number of historical sites, such as Robben Island, and regularly hosts quite a few popular festivals, including the Grahamstown Arts Festival and Cape Town Carnival. And when it comes to sports, the nation’s love for cricket and rugby has allowed talented individuals to be regularly ranked among the best in the world.

Since South Africa continues to be a popular tourist destination, its customs and excise authorities play a vital role in ensuring the seamless movement of imports and exports of goods. And to make the experience easier for international travelers, the South African government allows foreign visitors to claim back the tax paid on the goods that they purchase at the time of their departure. So, if you have recently spent a memorable time in the country and obtained some items that you desire to take with you on your way back, then our comprehensive guide will assist you in claiming a VAT refund.

Steps to Claim Your VAT Refund

Starting April 1st, 2023, the South African Revenue Service (SARS) has appointed a new service provider, known as the VAT Refund Agency (VRA), directly responsible for handling tax refund claims of applicants.

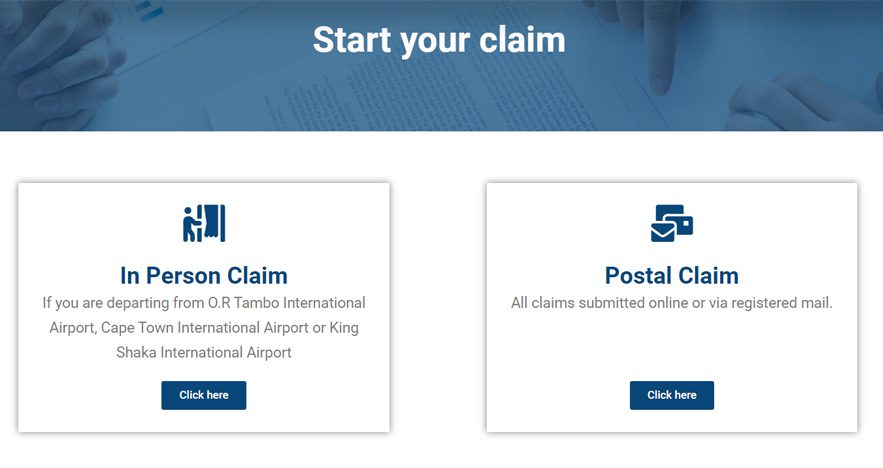

The de facto process for obtaining a VAT refund is ideally carried out in person. In this process, passengers/applicants who are departing from O R Tambo International Airport in Johannesburg, Cape Town International Airport, and King Shaka International Airport in Durban can opt for the same. To start an in-person claim today, follow the suggested steps below judiciously.

- The primary step involves the documentation process, where you need to inform the retailer or business (from where you are purchasing the goods) that you are a foreigner and want to claim a VAT refund.

- Proceed to request an original tax invoice for your purchases from the retailer. If the total cost exceeds 5,000 South African Rand, then your name and address must be clearly indicated on the invoice. Alternatively, if the total cost exceeds 10,000 South African Rand, then you need to provide proof of payment, such as a credit card receipt. Also, ensure that you carry the original tax invoice with you.

- Before you make your final departure from South Africa, all your purchased goods must be presented for inspection before customs officials, VRA officials, or both. Remember that the inspection process is usually carried out in the departure hall before checking in for your flight.

- Once the inspection is successfully completed, you will need to present your claim at the VAT Refund Office at any designated airport. Additionally, you also need to showcase your original passport, original tax invoices, and your boarding pass.

- After completion of the procedure, the requisite VAT refund will be paid directly into your account. However, for claims worth more than 3,000 South African Rand, it can take up to 90 days.

Keep in mind that you will also be provided a reference number, using which you can track the progress of your VAT refund claim. To track your claim, visit here.

Other Ways to Claim VAT Refund

In addition to the aforementioned in-person claim, the agency also offers postal claim registrations. Postal claims can be made when departing from a designated port where a VRA agent is not present or when goods are exported via a cartage contractor. Details for each of the processes have been provided below as well.

When Departing From a Designated Port With No VRA Agent

- Start the process by submitting a letter to the VRA authorities explaining your circumstances and why you are opting for a postal claim, along with your postal address.

- Once you have drafted the letter, attach the original tax invoice(s) along with your passport and your proof of residency in the country where you belong.

- If you are exporting via air, then you need to provide the air waybill number, the flight number, and the date and place of departure. When exporting via sea, then provide your bill of landing. And when exporting via rail, then a copy of the freight transit order and a copy of the combined consignment note and invoice would be enough.

Please note that claims must be submitted within 90 days of export.

When Goods are Exported via a Cartage Contractor

When a transport company exports your goods on your behalf, it is the responsibility of the contractor to ensure that the required rules and regulations are met. The primary requirement states that goods must be exported within 90 days from the date of invoice, and the process must be carried out through a designated commercial port. Additionally, the goods must be delivered to an address in an export country, and the contractor must provide you with the original invoice(s).

Once the goods are delivered to you, you can raise a claim by following the steps below.

- Begin by drafting a letter to the VRA authorities stating your circumstances and your postal address.

- After that, attach the following documents to your letter: the original tax invoice, a copy of your passport, and a copy of the invoice provided by the contractor.

- Once done, mail the same and wait for a follow-up response from the relevant authorities.

Know the Requirements

According to the South African government, foreign visitors who make a purchase exceeding 250 South African Rand will be eligible to claim back the VAT (Value Added Tax) paid on the purchased items or goods. As of the current day, the government charges 15 per cent VAT on all purchases, which is indeed a very sizable amount of money, especially when claimed.

To be able to make a tax refund claim, tourists are required to present the purchase invoice(s), which can be obtained by simply identifying yourself as a foreign tourist to shop assistants and requesting a tax invoice(s). The tax invoice must contain the following information: the amount of VAT charged, the quantity and description of goods, a unique serialized tax invoice number, and the buyer’s name and address. This tax invoice, along with your goods, must be declared to a customs or VRA official (or both) at the time of departure from a designated commercial port in South Africa.

For further assistance or queries pertaining to your VAT refund claims, you can get in touch with the VAT Refund Agency authorities via phone at +27 10 025 6371. You can also contact them via email at info@vatrefundagency.co.za or support@vatrefundagency.co.za.