It makes a huge difference to have protective plans in place during crises as they help to avert massive financial drainage. No one can predict the future and your income can be reduced to nothing if you have not been preparing in advance by shopping for insurance plans intelligently.

Liberty Mutual Insurance Company offers an exhaustive list of attractive discounts that you can avail of to have yourself and your loved ones covered fully. Powerful digital tools and features on their website and mobile app have just made things simpler for you! It is one of the top-ranking auto insurance companies in the country but also deals in a whole range of customizable personal and commercial insurance packages.

It is important to bear your needs in mind before you shop for auto insurance as they could be of different types and the requirements differ with states. The general ones include liability, uninsured, and underinsured motorist coverage, but it is wiser to go for full coverage for greater security. A full-coverage option will also include collision and comprehensive insurance besides the general ones. There are add-ons like accident forgiveness, new car replacement, deductible fund, gap insurance, original parts replacement, among others.

The Liberty Mutual Insurance website and mobile app features are user-friendly and can be used to pay bills, manage policies, view policy documents, file and track claims, etc. App features like roadside support, and accident and emergency services allow you to call, upload photos, and document important information in real-time. You can qualify for Liberty auto insurance discounts under various scenarios, however, they vary by state.

In addition to auto insurance, you have the Liberty Homeowners Insurance that is available in all 50 US states. Apart from personal property, personal liability, medical payments, dwelling, etc, you can add and combine the following to your standard homeowner’s policy — identity theft insurance, blanket jewelry coverage, inflation protection and replacement cost coverage. Please check out their website to see the eligibility factors to obtain easy home insurance discounts.

When you have to report a claim with Liberty Mutual, here are the options to consider.

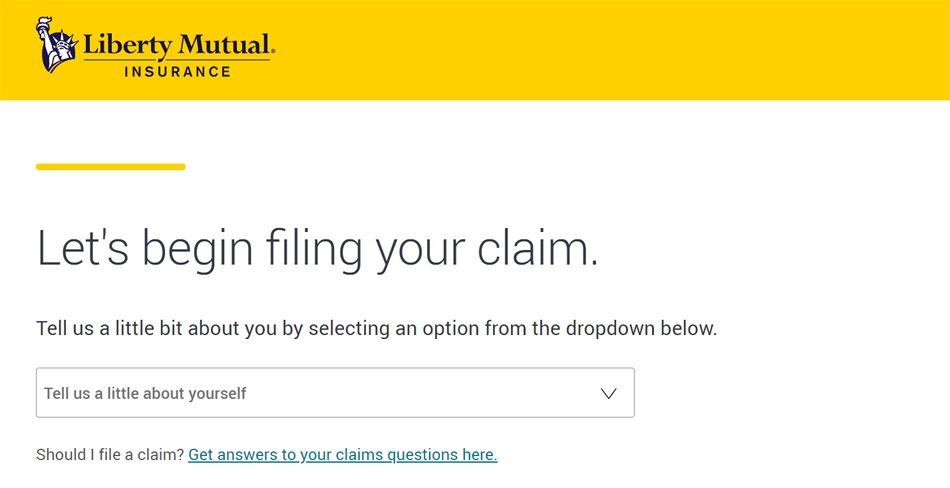

1. Submit a Claim Through Web Form

The Liberty Mutual Insurance website has in-built features that fast-track claim filing, managing, tracking, and processing. It is efficient and takes less than 10 minutes to get things sorted. The online facility has a zilch wait time and is available 24×7 to all its customers. The online claim filing process is similar for all types of claims. You just need to visit the relevant page and select the correct option from the dropdown bar to fill out the web form.

You will need the following data to file an auto claim – your username and password (to log into your account and file a claim); date, time, and location of the incident; policy number and last name; essential details of the accident; details of your policy coverage; and clear photos of the damaged vehicle

Remember that all claim payments are made after a damage review is conducted and submitted by a team of experts appointed by Liberty and are subject to paperwork and clearance which could be slightly time-taking depending on the situation. Once you file a claim, it is just as easy to track it here.

Home insurance claims need to be reported immediately so that an adjuster and claims representative can be appointed on your case to get things moving without delay. Ensure that you and your family are out of harm’s way and call customer support to report a loss and/or for any assistance that you may need to tackle the emergency. The sooner you upload photos of the damaged portions of the property along with necessary receipts and other requisite details, the faster things get underway. You can manage your claim through your online account.

2. Dial the Claim Helpline

You can report a claim via the mobile app, web form, or by calling Liberty agents at 800-225-2467. Online meetings with a claims representative can be scheduled to help them gauge the extent of the damage – auto or home. For customer support, you may call 800-290-8711.

Liberty Mutual staff do everything in their capacity to get you back on track post a massive loss. Payments are expedited once the damage is reviewed, and your policy is examined. Payments are made in alignment with the terms of the purchased policy.

If you have shopped Liberty insurance via an agent, you may even reach out to them as your first point of contact in the hour of crisis to move things further.

Alternatively, you can connect with a Liberty Mutual representative through Twitter or drop them a message on Facebook.

The moot point is to get to speak to someone at Liberty at the earliest and let them know about the incident. Follow their instructions, complete filing your claim, and track it online from time to time. Liberty representatives will keep you posted, and will let you know how to proceed to get your claim underway ASAP.

3. Visit the Nearest Branch

Except for a few states like Alaska, Iowa, Nebraska, North Dakota, South Dakota, Kansas, the District of Columbia, Puerto Rico, and Wyoming, Liberty Mutual Insurance has its offices in the rest of the US states. You can easily schedule an in-person meeting with a Liberty agent if you belong to states other than the ones mentioned here to help you with claim filing and submission. They can help you get things moving fast and forward.