Featuring a rich and complex history, South Korea’s insurgence dates back 5,000 years, when it was simultaneously influenced by the Japanese and Chinese cultures. However, it was only after the Korean War in 1953 that the country experienced rapid industrialization, and its economy grew at an alarming pace. And in today’s world, South Korea is one of the wealthiest countries, enjoying a diverse civil society, vibrant democracy, and a technologically advanced landscape.

Adding to the country’s already high GDP is the revenue earned by the Korea Customs Service (KCS). Formed under the Ministry of Strategy and Finance, the organization is primarily responsible for creating a fair and efficient customs environment to support the country’s growth as one of the global trade nations. Besides collecting customs duties and taxes, the KCS also prevents illegal trade, smuggling of cross-border goods, and enforcing national laws and regulations. So, whether you are visiting South Korea for personal reasons or for any business purpose and need to declare certain goods with the customs department before entering the country, you can easily do so by following our exhaustive guide.

Steps For Paying Customs Clearance Fee

Clearing customs in South Korea is a straightforward process. It all starts with your arrival, either through the seaport or the airport, and then claiming baggage after the initial checking process is completed. After that, passengers are required to opt for the customs declaration process.

Travelers who have items that need to be declared with the Korea Customs Service should stand in the “inspection line,” where the clearance will be completed swiftly (including the payment process). On the other hand, travelers who are without items that require declaration need to stand in the “tax exemption line”. However, keep in mind that some passengers may receive a surprise customs inspection based on the circumstances. With the basic rules and regulations out of the way, let us jump right into the steps you need to follow for your customs clearance process.

- Before starting your trip to South Korea, proceed to head over to the official website here.

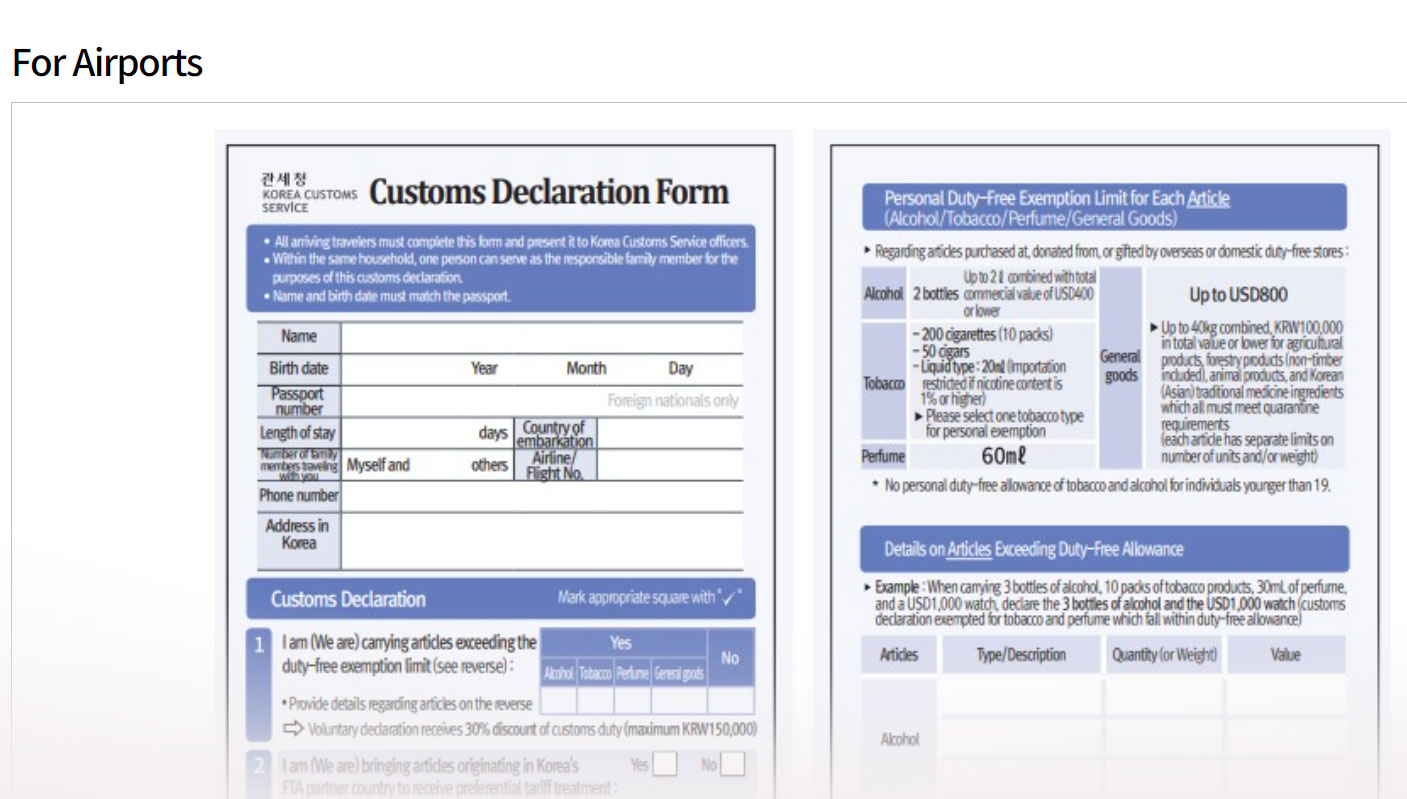

- On the landing page, you will find customs declaration forms for both entry via airport and seaport.

- Proceed to take a printout of the requisite form based on your arrival method.

- Once done, fill out the form with the relevant information, such as your name, date of birth, passport number, phone number, airline flight number or vessel name, etc. Ensure that you properly state the goods that you have to declare; otherwise, you will be liable for a fine and/or punishment.

- After that, carry the filled-out declaration form with you during your travel and present the same to the South Korean customs authorities on your arrival in the country.

- Lastly, you will be asked to pay the requisite customs fee (based on your goods import) and complete the clearance process. Usual payment processes include electronic modes of fund transfer, such as using your credit card or via internet banking.

Documents Required and Other Related Information

The only piece of documentation that you require to clear South Korean customs is your passport. This is because in the declaration form, you need to mention your passport number, and your passport will also be used to cross-check your name and date of birth. Hence, there should be no discrepancies between the two.

Apart from that, when it comes to duty-free exemption limits for each passenger, they have been listed below in detail.

Duty-free exemption limit for general goods is provided up to a maximum value of $800 (or 100,000 South Korean Won). The weight of the goods in total should be up to 40 KG (combined), and they can include agricultural products, forestry products (including non-timber products), animal products, and Korean (Asian) traditional medicine ingredients.

Duty-free exemptions for perfumes are limited to only 60 ml of total quantity. The combined value of all coins, stocks, currency, bonds, etc. should be less than $10,000. If the combined value is higher than $10,000, then the same must be declared.

Lastly, keep in mind that no personal duty-free allowance of alcohol or tobacco will be provided for passengers less than 19 years of age. Also, a list of prohibited and restricted goods is provided below.

Prohibited Goods: Sexually inappropriate goods; and counterfeit or forged currency, bonds, or other marketable securities.

Restricted Goods: Narcotics; firearms; and animals, plants, and their products, which are regarded as endangered species.

As the South Korean customs clearance process takes place in real time – by submitting the declaration form and paying the customs duties on the spot – it is generally completed within a matter of minutes.