Known for their customer service and competitive insurance plan offerings, Budget Direct is a well-reputed Australian insurance provider. Founded in 2000, the company implemented a disruptive online approach to providing car insurance plans simply by cutting out the traditional broker costs and selling directly to the end user. The concept quickly resonated with cost-conscious customers, ultimately helping the company reach swift popularity.

Since its nascent days, Budget Direct has started expanding its portfolio, offering other types of insurance, such as home, motorcycle, and travel. This was done to cater to a wide customer base and meet customer requirements on a vast scale. Additionally, the company also offers pet and life insurance plans, which further enhances its product portfolio going forward. Apart from providing comprehensive insurance coverage, Budget Line is also known for its easy-to-use online platform and its streamlined claims process.

If you are a Budget Direct insurance holder and want to know the process to register an emergency claim, then our in-depth guide can prove to be a lifesaver.

What are the Steps to Submit Claim Online

To submit a claim for your Budget Direct insurance plan, follow the suggested steps provided below.

- Start by first heading over to the link here.

- On the landing page, choose the type of insurance for which you want to submit your claim. For example, if you want to submit a claim for your car insurance, then choose the ‘Car’ option.

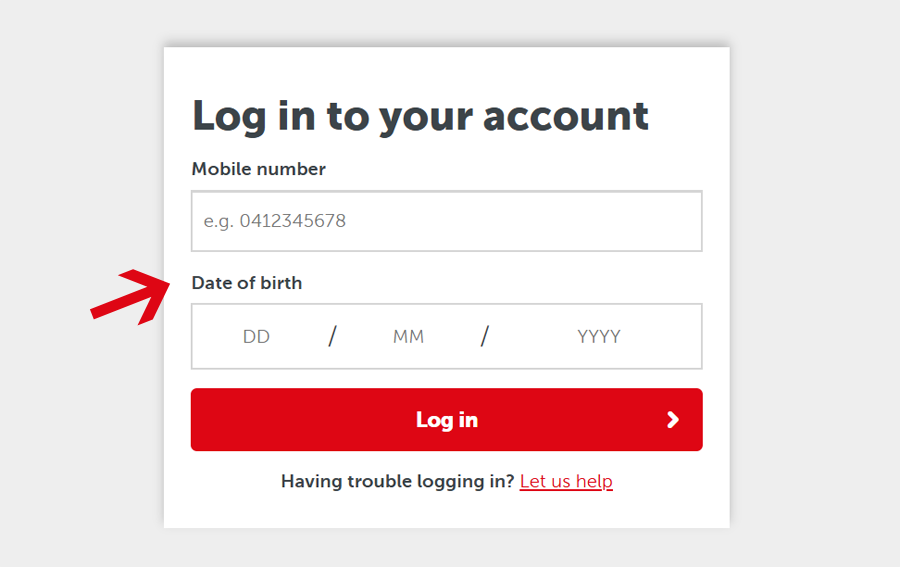

- A new web page will open where you will be required to sign in to your Budget Direct online account.

- The online claim portal is available 24×7, and you will need to state your registered mobile number and date of birth (as mentioned in the policy) to be able to sign in.

- After signing in, you will need to provide your policy number, details of the incident (including time and place) that led you to submit the claim, and any other relevant information as required. Additionally, you also need to provide supporting documents, so make sure you keep them handy.

- Once done, proceed to submit your claim successfully.

- After submission, you need to wait for an official response from the company’s claims department, who will advise you regarding the subsequent steps you need to follow. And if necessary, more information will be asked from your side.

- Once your claim is accepted and approved, you will get your due payment or assistance.

Other Ways to Submit Claim

The claim submission process for your Budget Direct insurance policy can also be completed over the phone, as is explained in the steps recommended below.

- First, you need to head over to the official website here.

- Select the type of insurance for which you want to submit your claim.

- You will then be redirected to a new web page, where you will be presented with the customer support phone number. Keep in mind that the customer service phone numbers vary based on the type of insurance you are selecting, so ensure you use the proper one.

- Once you obtain the requisite phone number, proceed to make a call.

- When speaking with a customer support representative on the call, provide your name, policy number, and the issue you are facing for which you want to raise the claim. Any other additional information, as asked by the customer care agent, should be disclosed as well.

- After successfully submitting your claim request, you will now have to wait for an official response from the company’s dedicated claims team.

Overview of Products

Budget Direct offers a wide variety of insurance products, primarily in the ‘personal insurance’ category. However, their core competency lies in the car insurance business. With Budget Direct car insurance plans, you get access to comprehensive coverage that includes repairs or replacement of your car, along with add-ons such as accidental breakdowns or roadside assistance.

Then you have Budget Direct’s home and contents insurance, which protects your home and belongings against loss or damage from storms, fire, or theft. You also get policy add-ons such as legal liability coverage, which is up to $20 million (including GST). With legal liability cover, any accidental injury or property injury to others will be taken care of. There are also additional coverage add-ons, such as flood cover, valuables cover, personal belongings cover, etc.

Budget Direct also sells motorcycle insurance policies that offer comprehensive coverage, including repair expenses or replacement. Motorcycle insurance plans involve add-ons such as riding gear cover and roadside assistance. And then you have pet insurance offerings that cover eligible veterinarian bills for your furry animals when they are suffering from illnesses or accidents.

Lastly, you get access to travel and life insurance coverage policies with Budget Direct. Travel insurance covers medical expenses, trip cancellation expenses, lost luggage, flight delays, personal liability, and high-value items cover. On the other hand, life insurance plans include term policies, income protection policies, and total and permanent disability policies.