If you are considering low-priced insurance products and multiple policies, then State Farm is your best bet. It is spread well across the United States and is touted as the largest auto insurance company in 33 states, and the largest homeowners insurance company in 39 states. State Farm has been listed as the number one auto insurance company since 1942. It is no mean feat to continue to occupy the first spot for more than 80 years at a stretch. This makes it everyone’s preferred destination and easily the most reliable choice for all types of insurance.

State Farm pitches with other big-name companies like Geico, Berkshire Hathaway, Allstate, and Progressive to grab the top spot in the list of best-performing and top-rated insurance companies in the States. It is undoubtedly your one-stop shop for all your insurance needs.

What Makes State Farm Popular

Let’s take a look at other reasons why you should think State Farm when you are shopping for policies.

They are top rated! State Farm gets the maximum stars when compared with rivals like Geico, Progressive, and Allstate. They have been around for the longest time and are a stable company. Currently, they offer 100+ products to their customers. Additionally, their rates are one of the lowest in the market. They do multiple insurance policies besides auto and life. State Farm is dense with millions of policies on offer.

Did you know? Approximately 19,200 agents are working for State Farm. It’s the best fit when you are thinking of bundling products. The online services are quite coherent and structured as well. Their mobile app has received rave customer reviews and you can pay your bills, file and manage claims, request roadside assistance, etc, without a glitch. Some of the top State Farm products consist of auto insurance (car/motorcycle), life insurance, health insurance, travel insurance, home and property insurance (renters, condos, farm, home, etc), small business insurance, liability insurance, pet medical insurance and disability insurance.

Check out their official website to see their coverage options. They have pretty much everything that is common across the board with the highest customer satisfaction and ratings.

If you have a claim to report, here are 3 ways you can effortlessly do the same.

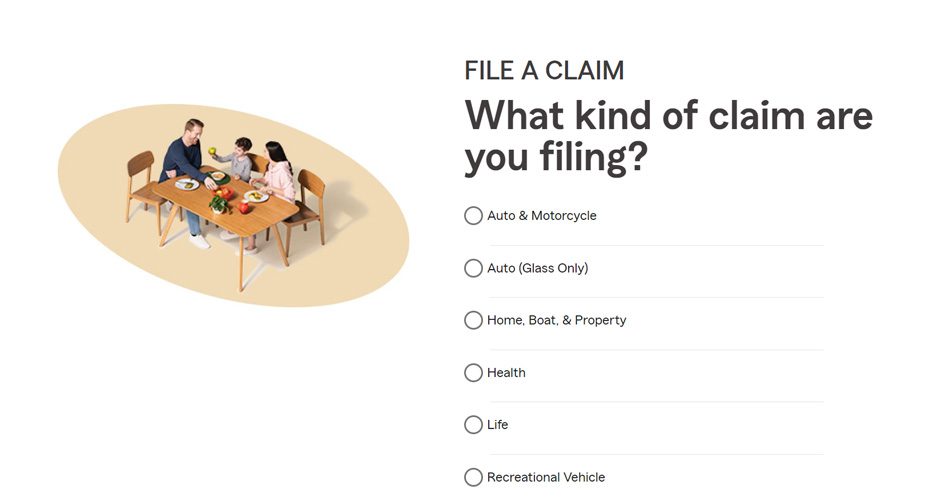

1. Submit Claim Through Web Form

If you are involved in an accident and must file a claim, visit the State Farm website and click on the Claims option. You can also file, manage, and track claims via the Mobile App. Things get expedited on the app as you also get to communicate with a Claims team, get notifications, and more. If it has been a big impact accident, you must not lose any time to inform the representatives (or even your agent) at State Farm. The bigger the loss, the more the need for you to file a claim. You may need to complete and submit a Personal Injury Protection (PIP) and/or medical payments coverage form if you have sustained accident injuries. Your claim associate can help you with this.

Visit the link here, and fill out the relevant details giving as much detail as you can about the incident. The process of filing a claim is the same everywhere. If you were not at fault, file a police report and upload that alongside the other documents like photos (use virtual estimation) from the accident site, and a full-length description of the accident, how/where/when it happened, people involved in the crash, their details, eyewitnesses (if any) and their details, etc.

Once your claim is filed with the company, it will take necessary measures to review and assess the situation before initiating payment for the repair. State Farm ensures they put you back on track at the earliest without unnecessary delays. If you are not using the Select Service shop, you may be missing out on a few perks like guaranteed completion dates; written, limited-lifetime warranties that are honored nationally; and direct payment to the shop by State Farm.

2. Connect With Call Center Executives

If you are more comfortable talking to a representative at the call center, you may reach out anytime during the day or night at 800-732-5246 for auto, home, and property claims. The executives are well-trained enough to guide you through the claims process once you explain to them in detail exactly what happened, where (location), and when (time and day). They will keep you posted on everything via a proper communication channel like email. Let them know the estimate of damage and send relevant documents with pictures so that they can get your payment underway (minus your deductibles). To get an estimate, use a Select Service shop or whichever one suits you.

State Farm will either make a direct deposit to your account, send you a check, or will pay the shop for the repair work — you give them the choice.

3. Meet an Agent Near You

State Farm has an outstanding network of agents working for the company. They are found easily across all the US states. A good connection with an agent can simplify a lot of things for you on the ground. You stay more updated and feel supported by a known professional around. Moreover, it is always a plus to reach out to an agent first to settle claims and go through them to avoid any hiccups during the claims process. They fight the battle for you!

State Farm scores brownie points over Geico and Progressive in this context because the latter is lacking in live agents. Sometimes this can be the biggest hindrance and is perceived to be a negative because some resolutions are handled better offline than online, and customers connect more spontaneously with their agents than the executives on the phone at the call center.