From being the leading government agency for trade facilitation to enforcing revenue collection from imported or exported goods in Singapore, Singapore Customs has been instrumental in building trust in the country’s external trading system. Since its inception, the organization has been a flagbearer in boosting the country’s economy by implementing trade controls, collecting customs and excise duties, and investigating smuggling or any other offences.

The foundation of Singapore Customs goes back to the early 1900s when it was established to collect duties on the import and export of drugs (such as opium), spirits, and alcoholic liquors. Over time, the organization evolved, and in 2003, it was merged with the Singapore Trade Development Board to create the present governing body that it is.

With that being said if you have recently imported any overseas goods and the Singapore Customs department has notified you to clear the GST (Goods And Service Tax) and duty payment, then our comprehensive guide can help you sort out the same.

Steps For Paying Custom Clearance Fee

According to Singapore Customs, travelers who are arriving in the country are required to declare and pay GST and duty for importing or bringing in taxable or dutiable goods that exceed their duty-free concession and GST relief. As of today, dutiable goods in Singapore include intoxicating liquors (alcoholic strength that exceeds 0.5% by volume), tobacco products, motor vehicles, and motor fuel (such as diesel products, compressed natural gas, and motor spirits).

To pay your customs duty and GST today, follow the recommended steps laid out below.

- Start the declaration and payment process by heading over to the official website here.

- On the landing page, click on “Declare Goods,” and you will then be presented with all the necessary terms and conditions. Proceed to read through the same, and then click on “I Agree”.

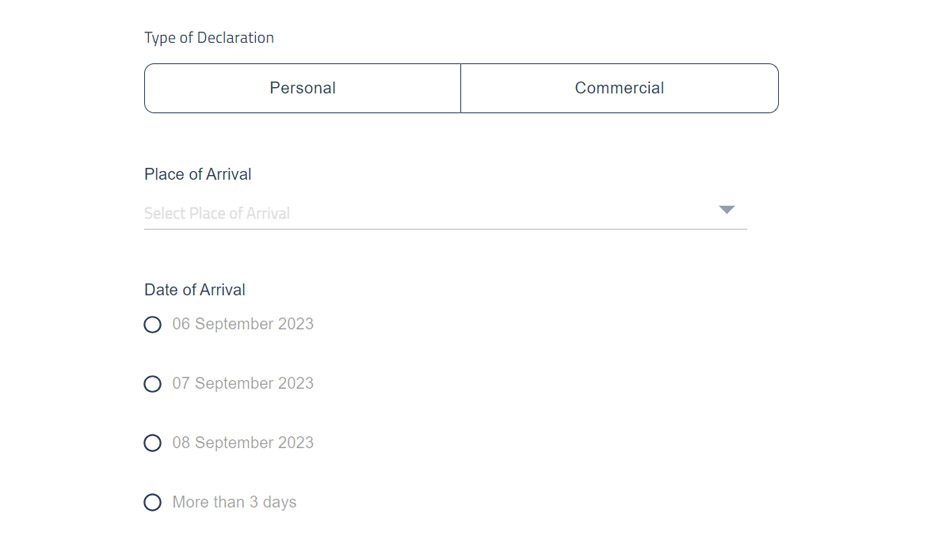

- In the next step, select your “Type of Declaration” between “Personal” and “Commercial”. Once done, you need to select your place and date of arrival. Keep in mind that you can submit a declaration for customs clearance only up to 3 days in advance. Then click on “Next”.

- After that, you need to disclose whether you are a pass-holder or a crew member. Remember that if you are a crew member and are away for less than 48 hours from Singapore, no duty will be levied for goods up to the value of 100 Singaporean dollars. For crew members who are away from Singapore for 48 hours or more, no duty will be levied for goods up to the value of 500 Singaporean dollars. Once you have selected that, enter the description of your goods, the value of the item, and the value in currency. Once done, click on “Next”.

- In the subsequent step, you will be provided a summary of the amount of duty you have to pay, and upon clicking “Next” again, you will need to enter your passport number, full name, email address, and phone number. After that, click on “Make Payment”.

- Finally, proceed to pay the requisite amount online, and do not forget to take a printout of the payment receipt for future reference.

Please note that the supported payment options include all major credit cards (Visa, MasterCard, and American Express). However, if you are paying at the Singapore Customs Tax Payment Office, then you get additional options to pay via mobile wallets, Cashcard, or the NETS banking system.

Documents Required and Other Related Information

The primary reason why the Singapore Customs Department has created the above-mentioned advance declaration and customs clearance process is to ensure that when you arrive in Singapore, you do not need to visit the Customs Tax Payment Office at the checkpoint, ultimately making your travel process more seamless.

Since the payment was already made before your arrival, you will be notified via email to download your payment receipt. As a result, you will then be able to exit the checkpoint through the Customs Green Channel, and if in any case you are stopped for checks, you can easily showcase the e-receipt on your mobile device or a printed hardcopy as your proof of payment.

But, before you decide to declare your goods to the Singapore Customs Department for the payment of GST and duty, there are certain conditions that need to be fulfilled. As per the customs authorities, you will need to pay GST and duty if you are carrying any of the following mentioned item(s): tobacco products in excess of 0.4 kilograms; liquor products in excess of 10 litres; motor fuel in a spare container of a motor vehicle in excess of 10 litres; precious metals for personal use weighing in excess of 0.5 kilograms; goods for commercial, trade, or business purposes for which the GST payable exceeds 300 Singaporean dollars; or goods marked as trade samples whose value exceeds 400 Singaporean dollars.

Additionally, the Singapore Customs Department has also implemented a concession policy for GST and duty, provided certain conditions are met. For starters, tobacco and cigarette products, along with motor fuel, do not enjoy concessions from GST and duty. GST import relief is applied for new articles, gifts, souvenirs, or food preparations, especially if they are for personal use or consumption. Used articles and personal belongings also come under the purview of the GST concession.

How Much Time Does the Clearance Take?

As goods are declared and payment of GST and duty is completed before arrival, the clearance process through the Customs Green Channel will be carried out immediately, provided that the individual presents the printout receipt or e-receipt as proof of payment.

For any additional assistance, you can get in touch with the Singapore Customs Department via phone at +65 6355 2000. Phone lines are open between 8 AM and 6 PM, from Monday to Friday, as well as between 8 AM and 12 PM on Saturdays. Offices are closed on Sundays and public holidays.