Respected as the world’s largest law enforcement organization, the US Customs and Border Protection (CBP) carries the responsibility of protecting the country’s borders and promoting the nation’s economic prosperity. The primary mission of the agency has always been to enforce national laws and regulations, mitigate terrorist activities, and facilitate international trade and travel. In addition to that, the CBP also prevents shady practices such as drug trafficking and the illegal movement of goods in and out of the country.

As of the present day, US Customs and Border Protection operates at more than 300 points of entry across the nation, including land and maritime borders. And its workforce of more than 60,000 employees also plays a major role in inspecting imported goods for diseases and pests, reserved specifically for livestock and crops. So, if you happen to be arriving in the United States lately and are carrying certain items that need to be inspected by the customs department before you pass through the US borders, then it is essential to learn the ins and outs of the process through our guide below.

Steps For Paying Custom Clearance Fee

According to the US Customs and Border Protection authorities, whether you are a visitor to the United States or a US citizen arriving in the country, certain formalities need to be completed with the help of one or more entry forms.

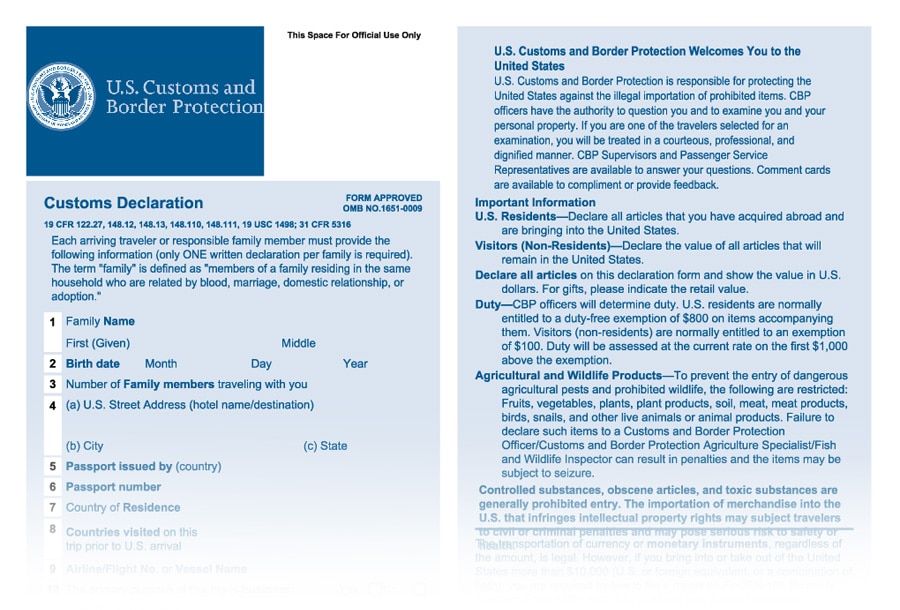

To start things off, arriving passengers are required to fill out the CBP declaration form here. This form will collect basic information about you and the goods (if any) you are bringing into the United States, including wildlife and agricultural products. Also, if you are traveling with your family members, then a form including all the associated members must be completed. To complete the clearance process seamlessly, follow the steps suggested below.

- Start by filling out the above-mentioned declaration form before or during your travel. The form can be completed either by typing and then printing it out or by printing it out first and then filling it out using handwriting.

- Once done, the completed form must be carried with you during your official customs declaration and clearance process.

- Submit the form to the relevant CBP officer along with the requisite customs payment/duty on the spot.

It should be known that the CBP accepts all types of electronic payment options, including debit and credit cards.

Documents Required and Other Related Information

Before you decide to submit your declaration form for customs clearance, remember that the only two documents that you have to refer to (in the form) are your passport number (or any other travel document), along with the name of the issuing country, and your airline/flight number or vessel name. Apart from that, you have to provide the usual information, such as your name, birth date, residential address or hotel destination, total value of goods, etc.

Talking about the items that you need to declare when entering the United States, include: food and agricultural products; alcoholic products; currency; and pharmaceuticals. However, there are certain exemptions relating to each item that you need to remember. For starters, all foods, plants, and agricultural items that enter the United States must be declared. These include fruits, vegetables, plants, plant products, soil, meat, meat products, birds, snails, and other live animals or animal products.

Medications and pharmaceuticals (up to a 90-day supply) must be declared in their original packaging with a prescription in the traveler’s name. Lastly, for currencies or other monetary instruments, any amount in excess of $10,000 (or foreign equivalent) must be declared.

Additionally, the declaration process for US residents differs compared to non-US residents. For US residents, all goods that you have acquired abroad and brought into the United States must be declared. However, for non-US residents (visitors), the total value of all the goods must be declared. Apart from that, US residents are usually entitled to a duty-free exemption of up to $800 on the items accompanying them.

Alternatively, for non-US residents, the exemption value is $100. And for both of the aforementioned scenarios, duty or the amount of customs that is to be paid will be assessed at the current rate on the first $1,000 above the exemption limit. Also, remember that only CBP officers will determine the actual duty.

How Much Time Does The Clearance Take?

The clearance process by the US Customs and Border Protection authorities is usually completed within minutes of your arrival in the United States, provided you have the declaration form filled out and ready to go. As a result, you can expect minor to no delays.

For any additional assistance, you can get in touch with the customs authorities via phone at 877-CBP-5511. Phone lines are available from Monday to Friday, between 8:30 AM to 5 PM ET.