There’s no denying that when it comes to the fleet size and passenger count, nothing can match IndiGo. Touted as India’s largest airline operator, the company primarily focuses on affordability, punctuality, and customer satisfaction, making its services efficient and reliable. Founded by Rajiv Bhatia in 2006, the airline initially operated across a few Indian cities. However, as the news of its low-cost, no-frills service started to gain traction, it was a no-brainer for the operator to quickly ramp up its operations.

Over the years, IndiGo continued to expand its reach, adding new routes and destinations, not only in India but also abroad. This allowed the operator to constantly invest in modern technology and equipment, further increasing its efficiency. The company also manages a large fleet of over 370 aircraft, which encompasses not only the usual variants from Airbus but also recent additions from Boeing.

If you regularly travel via IndiGo and have recently booked a ticket for which you want to obtain a tax or GST (Goods and Services Tax) invoice, then our straightforward guide can help you obtain the document with ease.

Steps to Get Tax Invoice Online

According to IndiGo, the applicable GST payable will be based on the GSTIN (GST Identification Number) submitted during the booking process as well as the embarking location for each leg of the travel. And to ensure that a proper tax invoice can be issued by the airline, the individual must present the GSTIN ID (in capital letters), name of the registered GSTIN holder, and email address correctly during the time of booking – whether or not the booking is made through a travel agent.

Once the booking process is successfully completed, the tax invoice will be directly mailed to the provided email address. Keep in mind that the GSTIN ID or any other information can only be entered at the time of initial booking (before generation of the PNR or Passenger Name Record) and not at a later date.

With that being said, if you are looking to get yourself a copy of the tax invoice for the travel booking you made with IndiGo, then be sure to follow the requisite steps outlined below.

- Begin your journey by first visiting the official GST invoice portal for IIndiGo.

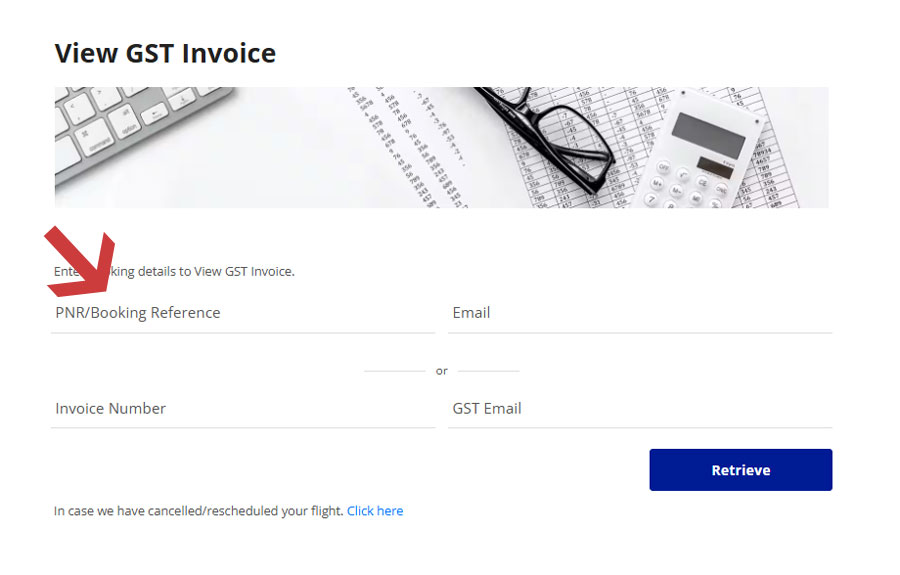

- On the landing page, you will be provided with a web form that you need to fill out.

- Start by providing your ‘PNR/Booking Reference’ number and the email address that was used for the booking. Alternatively, you can state the last name of the individual for whom the booking was made.

- Once done, click on ‘Retrieve’ and you will be able to download the tax invoice seamlessly from the company’s servers.

How to Request on Phone

For any reason, if you are unable to extract, retrieve, or download your tax or GST invoice through the official GST portal of IndiGo, as mentioned beforehand, then you can complete the process by requesting it over the phone from the company’s customer support.

To initiate the process, follow the recommended steps provided below.

- Start by first giving a phone call to the IndiGo customer support at one of these numbers: 0124-6173838 or 0124-4973838. Phone lines are available 24×7.

- Select the appropriate on-call options so that your call gets forwarded to the correct department and is then attended by a live agent.

- Once the customer support agent connects to your call session, state that you want to obtain the tax or GST invoice for the travel or ticket booking you made earlier, and then provide the requisite booking reference number and the individual name for which the booking was made.

- After that, the customer care agent will ask you the email address using which the booking was made, and once you provide that, the invoice will be mailed to you in due time.

Some Useful Information

Before you decide to obtain the tax invoice for the booking you made with IndiGo, it is imperative that you have a brief rundown of the registration numbers or GSTIN IDs that the company has in each state and union territory in India. The company also states that tax invoices will only be issued in Indian (INR) currency, even in cases when the payment might be made in a foreign currency.

It should be known that the fees and charges recovered for Special Service Request (SSR), which include excess baggage, flight modification, flight cancellation, etc., are always included in GST at the applicable rate.

Lastly, travel agents who are looking to obtain a proper tax invoice must ensure that the GSTIN ID, name of the GSTIN registered person, and email address are correctly provided during the time of booking. Doing so will allow the operator to directly send the tax invoice to the provided email address after a successful booking.