Being the recognized flag carrier of Turkey, Turkish Airlines has been a major player in the global aviation industry for quite some time. The company’s rich history traces back to the 1930s, when it started its operations as a small airline operator functioning with just five aircraft. Over the decades, the airline underwent a series of transformations, expanding its fleet and routes gradually.

A pivotal moment in Turkish Airlines’ history came in the early 2000s, when it joined Star Alliance, a global airline network. Such a strategic move allowed the company to access a vast network of destinations, accelerating its growth and popularity on the international stage. Presently, it boasts as one of the world’s largest airline networks, connecting multiple continents, including Europe, Asia, Africa, and the Americas. And the company also operates a modern and efficient fleet of aircraft, including Boeing and Airbus models, while also constantly investing in new technologies to enhance the operational efficiency.

With that being said, if you have booked a flight directly through Turkish Airlines in India and want to obtain the tax or GST (Goods and Services Tax) invoice generated for the same, then be sure to follow our all-inclusive guide till the end.

How to Get Invoice Online

Turkish Airlines states that you can obtain the tax or GST invoice for the ticket booking you made within 72 hours from the time of issuance. And if your ticket is issued by a travel agency, then you need to contact the agency and obtain your invoice.

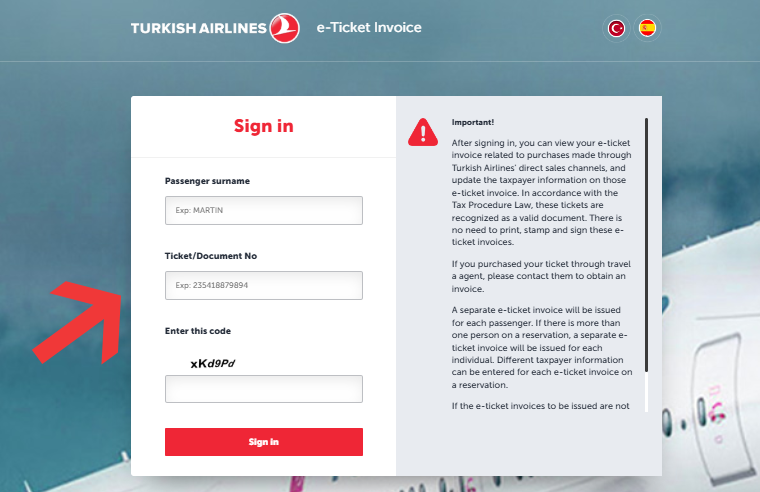

To get your tax invoice directly from Turkish Airlines, follow the recommended steps outlined below.

- Start the process by first visiting the official website.

- On the home page, you will be asked to enter the passenger surname (under whose name the booking was made) and the ticket (or booking/document) number.

- Once entered, click on ‘Sign In’ and you will be able to view your e-ticket invoice related to the bookings you made directly through Turkish Airlines.

- Proceed to update the taxpayer information on the e-ticket invoice(s) that you require. The entered data will be updated on a real-time basis.

- Lastly, download the invoice(s) you require for your tax benefits, and you will be good to go.

Keep in mind that there is no need to get the e-ticket invoice(s) signed or stamped, as they are already recognized as valid document(s).

How to Request on Phone

In addition to requesting your tax or GST invoice online, you can also request the same over the phone by getting in touch with the Turkish Airlines customer support. The airline operator has physical offices in India, and you can follow the below-mentioned steps to complete your objective.

- The primary step involves calling the customer care helpline at 0008000501565. Phone lines are available 24 hours a day.

- Choose the appropriate IVR (Interactive Voice Response) options so that your call gets forwarded to a customer care executive.

- As soon as a live agent connects to your call, state that you want to obtain the tax invoice for the booking you made recently. After that, provide the name of the passenger under whose name the booking was made, as well as the ticket or booking number.

- Once the customer care agent retrieves the e-ticket invoice, you will be required to state the GST details of the person who is planning to use the invoice for claiming tax benefits. These include the GST registration number, name in which it is registered, its registered address, phone number, and email address.

- After providing all the necessary data, the same will be entered on the invoice and will be mailed to the email address that was used at the time of booking your ticket. The customer care representative will let you know the estimated time of arrival for your invoice.

Some Useful Information

Before you decide to get your tax or GST invoice through any one of the processes mentioned beforehand, keep in mind that if there is more than one person in a booking or reservation, then a separate e-ticket invoice will be issued for each individual. In such cases, you will have the option to enter different taxpayer information for each e-ticket invoice on a reservation. Turkish Airlines also state that if the issued e-ticket invoices are not valid in the place or country where you are located, then you may need to contact the company’s customer support, present in that country.

Additionally, when updating the taxpayer information on the e-ticket invoice, remember that you have until the 10th day of the month following the month when you had purchased the ticket. Once the aforementioned time frame elapses, you will only be able to view your invoice and not edit the taxpayer information mentioned in it. And after you update the tax information in the invoice, the same will be sent to the specified email address within the next 72 hours.