For an airline operator that was established as recently as 1993, Qatar Airways has shown tremendous prowess and growth, becoming well-known for its luxurious amenities, exceptional service, and extensive global coverage. What started as a business consisting of a fleet of four aircraft became a billion-dollar enterprise in just a short period of time, which allowed the company to join the prestigious Oneworld Alliance in 2007.

Over the years, Qatar Airways has consistently set new standards in the aviation industry by banking on customer satisfaction, ultimately earning them numerous awards and accolades. Presently, the airline operator connects passengers to over 150 destinations across the world with its modern fleet of aircraft, which consists of the iconic Airbus A380 as well as the Boeing 787 Dreamliner. In addition to being at the forefront of technologically advanced transportation options, Qatar Airways has also invested heavily in fuel-efficient aircraft and sustainable practices to reduce its environmental impact.

Having said that, if you have booked any flight ticket or travel via Qatar Airways in India and want to obtain the tax or GST (Goods and Services Tax) invoice for the same, then our extensive guide can help you learn about the process in detail.

Steps to Get Your Tax Invoice Online

In July of 2017, India introduced GST, replacing its previous indirect tax regime, and ushering in a new change. As a result, Qatar Airways had to comply with the new tax regulations, and thus the company currently issues GST invoices for all bookings made directly through them.

To obtain the tax invoice for the ticket or travel booking you made with Qatar Airways, follow the outlined steps mentioned below.

- Start by first heading over to the official website.

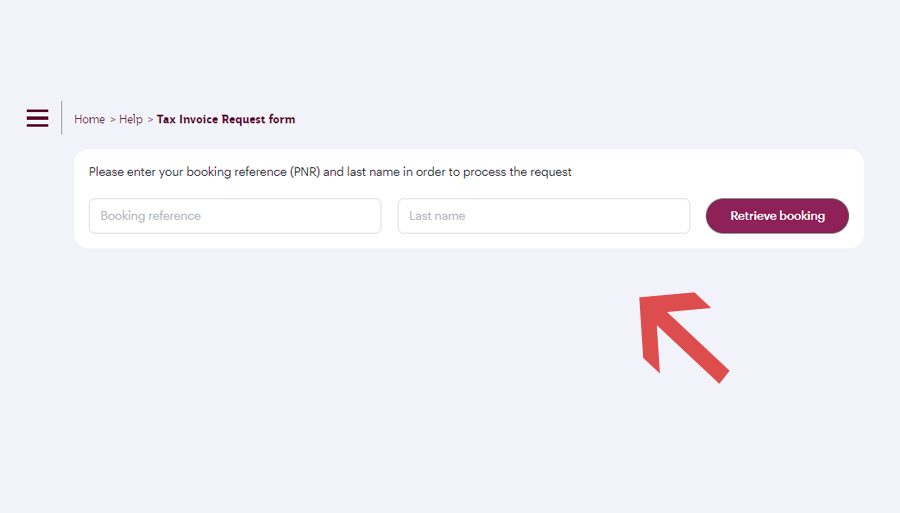

- On the landing page, you will be required to fill out some necessary information.

- Start by first providing your ‘Booking Reference’ number and then the ‘Last Name’ of the individual, on whose name the booking was made.

- After that, click on ‘Retrieve Booking’ and the system will generate the GST invoice for the same.

- Once done, simply download the invoice and use it for filing your tax returns.

How to Request on Phone

In addition to obtaining your tax invoice online from Qatar Airways through the above-mentioned process, you can also put in a request over the phone by getting in touch with the company’s customer support.

To begin the request process, follow the recommended steps mentioned below.

- The primary step involves giving a call to the customer support of Qatar Airways in India at +919512972827. Phone lines are available 24×7.

- Choose the appropriate on-call options so that your call gets forwarded to the customer care executive of the correct department.

- Once a live agent connects to your call session, state that you want to obtain the tax invoice for the ticket or travel booking you made recently.

- After that, provide your booking reference number as well as the name in which the booking was made. Additionally, state your preferred email ID to which you would want the invoice to be mailed (ensure it is the same as registered on the GST portal).

- The customer care representative will then register the request in your name, and a copy of the invoice will be mailed to you based on the estimate provided by the agent.

Some Useful Information

Before you decide to obtain a GST invoice for the booking(s) you made with Qatar Airways, keep in mind that such an invoice can only be obtained by a GST-registered individual in India, having a valid GSTIN (GST Identification Number). Additionally, the individual must provide the same address, phone number, and email address that are registered under the GST portal.

Qatar Airways states that GST information must be provided within 3 days from the date of transaction or the date of travel, whichever is earlier, which will enable the company to process the information quickly and issue the tax invoice without any delay. It should also be remembered that when you are providing the GST registration information for the invoice, ensure that the same is accurate, complete, and legally valid. This is because the approval of the GST claims lies at the sole discretion of the Indian tax authorities, and Qatar Airways will not be responsible for any legal repercussions, penalties faced, or claims denied due to incomplete or incorrect information provided.

When it comes to GST (K3) refunds on tickets issued by Qatar Airways in financial year starting from 1 April 2023 to year ending 31 March 2024 (FY 2023-24), the filing must be done with the Indian tax authorities on or before the cut-off date of 31 October 2024. After 1 November 2024, the refund process will not be eligible for any documents issued for the previous financial year, which is FY 2023-24. So, make sure you file your tax returns within time to claim the GST compensation.

Lastly, for any additional assistance, you can contact Qatar Airways customer support.