Emirates has been a cornerstone of Dubai’s economy for multiple decades. Known for its premium service, performance, and efficiency, the company has rapidly ascended to become one of the world’s leading international airlines. First launched in the year 1985, Emirates started their operations with just three aircraft and mostly served its regional bases.

As the years went on, especially during the late 1990s and early 2000s, Emirates saw unprecedented growth – partly because Dubai became an eye-catching place for tourists and partly because the company expanded its operations across multiple countries. During this time period, the company also made significant investments in its fleet, acquiring some of the most technologically advanced aircraft from Airbus and Boeing. Such investments allowed it to launch new routes around Asia, North America, South America, and Australia.

Having said that, if you have recently booked a ticket with Emirates and want to obtain a tax or GST (Goods and Services Tax) invoice for the same, then our extensive guide should help you find the correct resources easily.

What are the Steps to Get Tax Invoice Online

Emirates states that if you, as an individual, want to request a GST or tax invoice, then you need to make sure that you possess the following set of documents to support your request. For starters, you must have been registered for GST in India and should have a GSTIN (GST Identification Number) ID, and you are required by Indian GST laws to have a tax invoice to claim the tax credits.

Additionally, your ticket or travel must be booked with Emirates Airlines on or after 1st July 2017, because that is the date when GST in India came into force. And the request for obtaining the invoice must be placed within 5 days of the ticket or travel booking, as well as the date on which the Electronic Miscellaneous Document (EMD) or Multi-Purpose Document (MPD) that has been issued.

If you duly meet the aforementioned criteria, then you can effortlessly request your tax invoice by following the recommended steps provided below.

- Begin the tax invoice request process by first heading over to the official website.

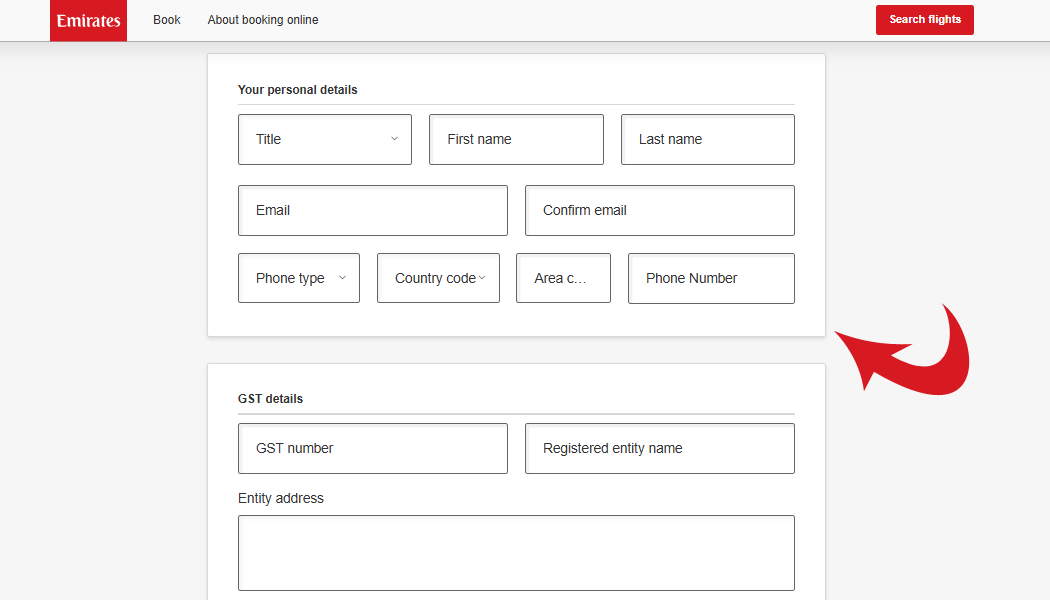

- On the landing page, you will be provided with a web form that you need to fill out. Start by first stating your full name, email address (preferably the one that was used for the booking), phone number, and area code (or pin code).

- In the next step, under ‘GST Details’, you will need to state the GST number or GSTIN ID of your business along with the name in which the entity is registered with the GST portal.

- Once done, provide the registered address of the entity or business along with the ticket number or the MPD/EMD number.

- Lastly, click on ‘Submit’ and your request will be successfully submitted.

Emirates states that once your request is registered on their system, the invoice will be mailed to the provided email address within 30 days.

How to Request on Phone

Besides registering your request for a tax or GST invoice online from Emirates, you can also request it over the phone by giving a call to the customer support.

To initiate the request, follow the steps laid out below judiciously.

- Start by first giving a call to the following number: +919167003333. Phone lines are available 24×7, and English and Hindi language support are available in India.

- Navigate through the on-call options and select the option to speak to a customer care executive.

- Once a live agent connects to your call, provide your name, email address, and phone number.

- After that, state your registered GSTIN ID and the name of the entity to which the ID is registered. Then, provide your ticket number or the MPD/EMD number for which you want to obtain the tax invoice.

- As soon as the customer care agent receives all the required information, a tax invoice request will be registered, and the same will be delivered to your email address within the next 30 days.

Some Crucial Information

Before you proceed to submit your tax or GST invoice request online with Emirates Airlines, keep in mind to only submit a single form for each ticket, EMD, or MPD number. For instance, if you have 10 tickets and you want to obtain tax invoices for all of them, then you need to raise requests 10 times by submitting multiple forms.

Emirates Airlines also state that by submitting the tax invoice request form, you, as the holder of the GSTIN ID, confirm that the invoice that is being obtained will be utilized for lawful purposes or expenses incurred by the GSTIN-registered entity (whose GST details are provided in the form).

Additionally, in case of any legal repercussions later on, arising from the tax or GST invoice, where the details provided by the GSTIN ID holder are found to be incorrect, then the ID holder must compensate Emirates Airlines for any legal proceedings and penalties imposed by Indian tax authorities.