Headquartered at Hong Kong, Cathay Pacific Airways, with its distinctive green and white livery, is renowned for its vast network and comfortable cabins. It all began in 1946, when two companies, Guo-Min Aviation and Cathay Pacific Airways, merged to form the airline operator that we know today. During its heydays, Cathay Pacific initially operated through its limited infrastructure and volatile political climate of post-war Hong Kong.

Even with all the hurdles, Cathay Pacific continued to expand its fleet, especially with larger aircraft from Lockheed and Boeing, enabling it to reach destinations beyond Asia. Additionally, the airline’s reputation for safety and service grew, attracting passengers from around the globe. The airline was also the first to introduce the Boeing 747-400 to the world, setting new standards for long-distance travel. Apart from that, the airline has also been responsible for transforming Hong Kong International Airport into a major aviation hub, connecting passengers to destinations across the world.

If you have recently booked a ticket with Cathay Pacific Airways in India and want to obtain its tax or GST (Goods and Services Tax) invoice, then our extensive guide can help you show the ideal pathway.

How You Can Get Your Tax Invoice

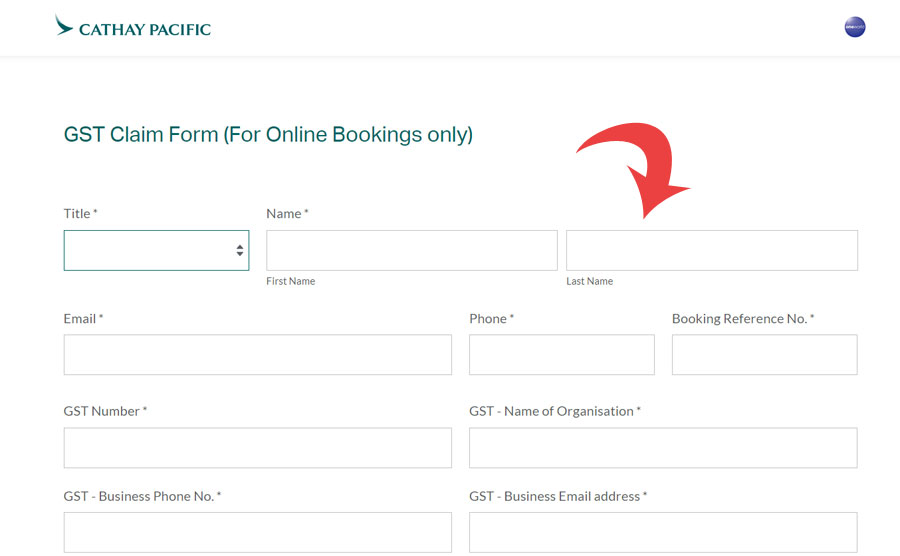

Cathay Pacific Airways states that if you have booked your flight ticket(s) or travel online through the web or via the company’s official smartphone apps (Android or Apple devices), then you can fill out the tax or GST claim form (mentioned below). The form must be filled out within 24 hours of the payment of the ticket, so make sure that you abide by the timeline.

To start the application process, follow the recommended steps provided below.

- Begin the process by first visiting the official website.

- On the landing page, you will find a GST claim form that you need to fill out.

- Proceed to provide your full name (the name in which the booking was registered), the email ID and phone number that were provided during the booking, and the booking reference number.

- In the next step, you will need to enter the GST number (or the GST Identification Number) and the name in which the entity is registered. Additionally, you need to provide the same phone number, email address, and business address as registered with the ID on the GST portal of the Indian tax authorities.

- Once done, click on ‘Submit Form’ and your GST claim form will be submitted successfully. After verification, a copy of the tax or GST invoice will be mailed to your booking email address.

How to Request Your Invoice on Phone

In addition to registering a GST claim form for Cathay Pacific Airways through the steps mentioned beforehand, you can also ask for a tax or GST invoice for the booking you made directly with the company by contacting customer support.

To get in touch with Cathay Pacific’s customer care, follow the steps outlined below.

- Kickoff by first giving a call to the toll-free number 000-800-050-2163 (domestic). If you are calling from abroad, then dial +852 2747 3341. Phone lines are usually available 24×7. However, if you are a Hindi-speaking individual, then the timings are from Monday to Saturday between 9:30 AM and 5:30 PM.

- Select the correct on-call options so that your call gets forwarded to a customer care executive.

- Once a live agent attends to your call session, state that you want to obtain a tax invoice for the booking you made recently and then provide the booking reference number as well as the name, phone number, and email address associated with the booking.

- After that, you will need to disclose the GST registration number and the name that it is registered in, as well as the registered phone number, email address, and physical address.

- The customer care agent will collect all the required information and then register your request. Once your request is verified, you will receive the invoice in your email inbox.

Some More Useful Information

As earlier stated, the GST claim form must be submitted to Cathay Pacific Airways within 24 hours of booking (either online or via app directly from the company). And if your booking involves multiple passengers, then separate GST forms must need to be filled out, specifically for the ones who need to claim the GST benefit.

Keep in mind that the eligibility to gain GST benefit will primarily depend on the correctness of the data provided by the customer, and Cathay Pacific will not bear any responsibility to validate any errors (such as spellings or typos) for the purpose of invoice generation.

If you have booked your ticket via a travel agent, then there is no need to fill out the GST claim form previously described. All you need to do is share your GST details with your travel agent to avail the GST benefit, and you will be good to go. However, if you still end up filling out the GST claim form, then keep in mind that your request will not be considered and you will not be able to avail the GST benefit.