Paying tax has become hassle-free, all due to the relentless efforts of the government in India. It is easy to understand the tax-paying process, but many people find it grappling when it comes to issues related to it. A taxpayer can have complaints pertaining refunds, e-verification, rectification of the filed returns, discrepancies between Form 16 and TDS deducted, doubts regarding the income tax filing process or other technical issues like validating the PAN, or Aadhar ID. The problems can be numerous, but there are easy ways you can get redressal. The income tax department has improved the grievance redressal system considerably, and you can register your grievance with a click. Standing in the queues or waiting for appointments is not required anymore as support portals by the income tax department guide the taxpayers in the comfort of their homes. Users can directly raise their concerns or register their grievances via online platforms. There are more than one ways to get you going.

Use Income Tax E-filing

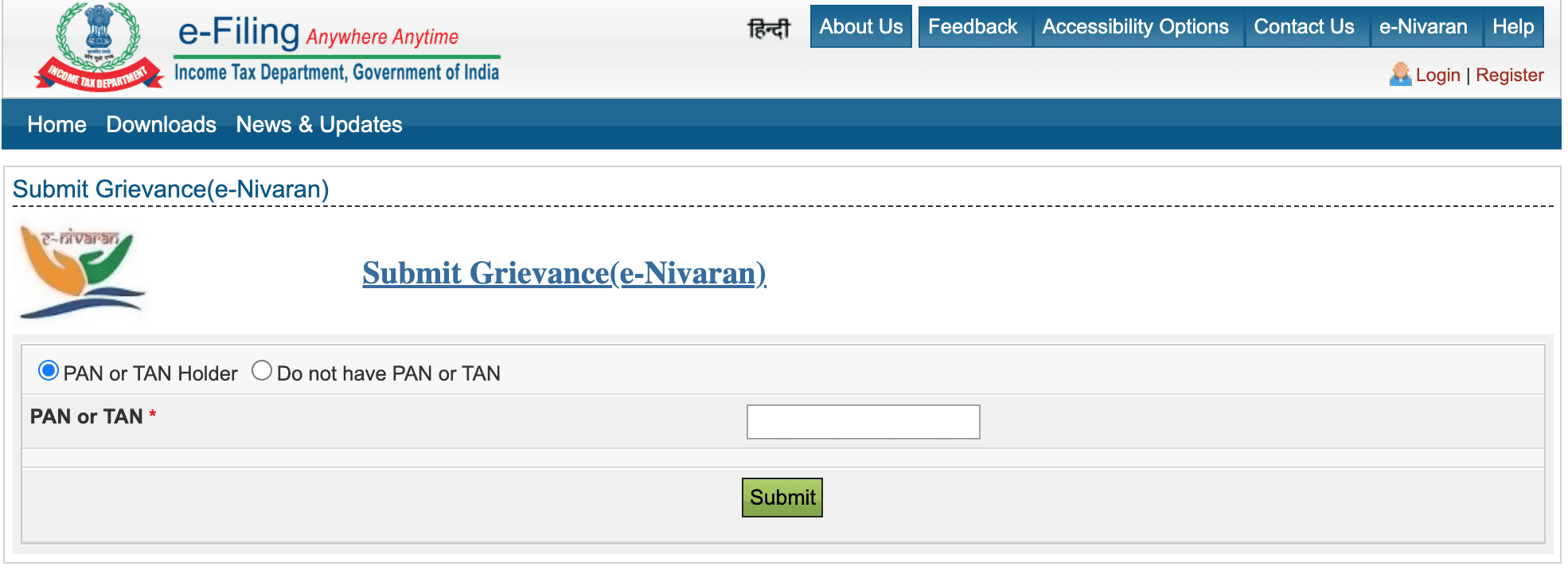

All the complaints about filing the income tax or related queries can be registered on the official tax portal. On the website, look for the ‘e-Nivaran’ on the top menu and click on it. You will be redirected to a new page. Click for ‘Submit Grievance’ option on the page, enter your PAN or TAN, fill in the grievance form and click submit to file your complaint. You will be given a grievance acknowledgement number, which can be used on the same website to check the status of your complaint.

All the complaints about filing the income tax or related queries can be registered on the official tax portal. On the website, look for the ‘e-Nivaran’ on the top menu and click on it. You will be redirected to a new page. Click for ‘Submit Grievance’ option on the page, enter your PAN or TAN, fill in the grievance form and click submit to file your complaint. You will be given a grievance acknowledgement number, which can be used on the same website to check the status of your complaint.

Through CPGRAMS Website

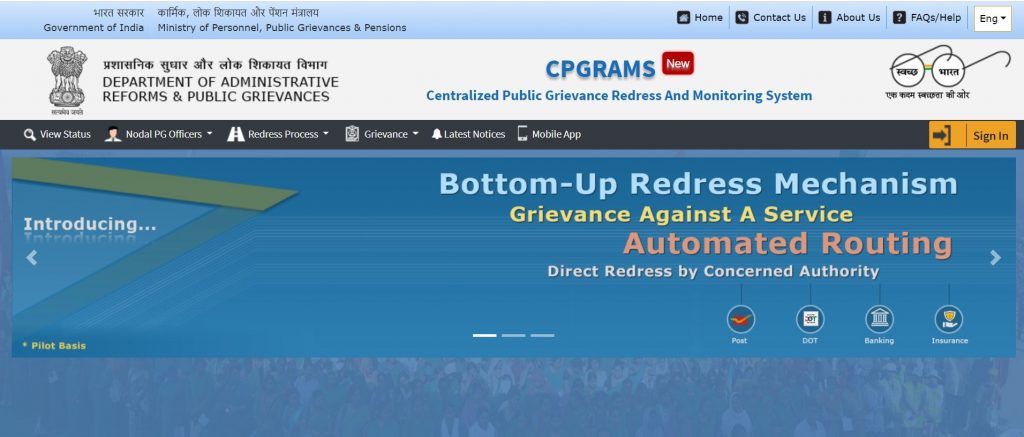

The Centralised Public Grievance Redress and Monitoring System is one of the popular ways to register a grievance against any government department. Yes, you can use the portal to register your grievance on the income tax department. Browse the website and click on ‘register new user’ on the top. It is compulsory to register before filing a complaint on the website. Once you are a registered user, you can click on ‘lodge public grievance’, and a redirected form will give you an option to choose the concerned department. Select the Income Tax Department and fill in the grievance form. Click submit.

Tax Helplines

The income tax department has made it easy for the taxpayers to contact the concerned department, whenever and wherever necessary. The website lists all the specific helpline numbers, and all you need to do is pick up the phone and dial the number. The website lists contact details for ASL (Aaykar Sampark Kendra) which take care of general queries, PAN/TAN updation, e-Filing of income tax returns, Refund/Refund re-issue/Rectification, TDS Centralised Processing centre (TRACES), and TRP Scheme (Tax Preparer Scheme).

The income tax department has made it easy for the taxpayers to contact the concerned department, whenever and wherever necessary. The website lists all the specific helpline numbers, and all you need to do is pick up the phone and dial the number. The website lists contact details for ASL (Aaykar Sampark Kendra) which take care of general queries, PAN/TAN updation, e-Filing of income tax returns, Refund/Refund re-issue/Rectification, TDS Centralised Processing centre (TRACES), and TRP Scheme (Tax Preparer Scheme).

The Grievance Redressal Portal for Regions

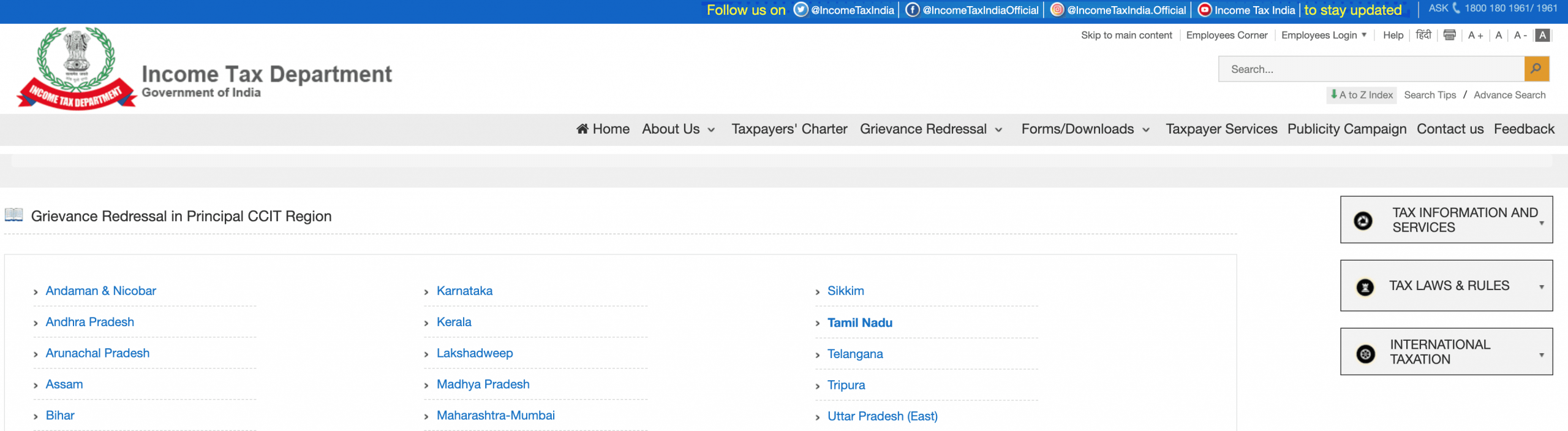

The tax department has made a grievance redressal portal available for all the taxpayers to help them file their complaints with regard to filing or refunds. The website lists the services for states separately. To look for the grievance redressal mechanism for your region, you will have to start by choosing your Principal CCIT Region. Once you have chosen the region, you will be redirected to the portal of the concerned state. Once you have clicked on your region, a new page will explain the mechanism for grievance redressal. You will now have access to the offices entertaining IT grievances, along with a list of contact information of the officers responsible for receiving grievance petitions.

The tax department has made a grievance redressal portal available for all the taxpayers to help them file their complaints with regard to filing or refunds. The website lists the services for states separately. To look for the grievance redressal mechanism for your region, you will have to start by choosing your Principal CCIT Region. Once you have chosen the region, you will be redirected to the portal of the concerned state. Once you have clicked on your region, a new page will explain the mechanism for grievance redressal. You will now have access to the offices entertaining IT grievances, along with a list of contact information of the officers responsible for receiving grievance petitions.