CRED is a Bangalore-based fintech startup that offers a credit card management platform to Indian consumers. It was started by Kunal Shah in 2018 to simplify credit card payments for users and to help them improve their credit scores. In less than 5 years, CRED has become a popular platform with over 6 million users to its credit.

CRED allows users to manage all their credit cards in one place. It provides them with a single dashboard to view and pay their bills. There are rewards for timely payments, which can be redeemed for discounts and offers on various products and services. It offers its users access to exclusive deals and discounts from top brands, including Amazon, Swiggy, and Uber.

The CRED Pay feature allows users to pay their rent, utilities, and other bills using their credit cards. CRED’s services are free for users and it generates revenue through commissions from credit card providers. The company is valued at over $4 billion.

Some of the key services provided by CRED are — credit card management that allows users to manage all their credit cards in one place, set reminders for bill payments and due dates, track expenses, and monitor their credit scores; exclusive deals and discounts from top brands are part of CRED’s reward system for users who make timely payments; and the CRED Pay feature that allows its users to earn rewards while paying for their regular expenses.

The platform also provides free credit score reports and updates to users along with personalized recommendations to help build their credit scores. It is a secure and hassle-free platform to pay credit bills; and CRED also provides users with personalized credit card offers depending on their credit score and spending habits.

Types of Redressal Issues at CRED

The Grievance Redressal Department at CRED may face a variety of redressal issues related to the services provided by the platform. The following are some common grievances of customers that the GRD may encounter —

1) Payment-related Issues: Customers may face problems related to the processing of payments, such as incorrect charges, failed transactions, delayed refunds, etc.

2) Credit Card Management Issues: These would include unauthorized transactions, incorrect credit limits, or delayed bill statements.

3) Reward Redemption Issues: Users eligible for rewards for timely payments may face difficulties with redeeming rewards, expired rewards, or incorrect reward redemption.

4) Account-related Issues: Account-related issues include login problems, account deactivation, or account security concerns.

5) Customer Support-related Issues: Customers can escalate issues if they have been unhappy with unresponsiveness, rude behavior, or unsatisfactory resolution on the part of customer support.

6) Technical Issues: App crashes, slow loading times, or other technical glitches fall within the ambit of technical issues.

The GRD plays a significant role in ensuring customers have a seamless experience with the CRED platform. To maintain customer trust and satisfaction, the GRD works to perfection and does its best to resolve all user concerns effectively and in a timely manner.

How to Contact for Grievance Redressal

If you are facing any issues with CRED’s services, you can approach the Grievance Redressal Department (GRD) in several steps, which have been listed below for your convenience.

If you are facing any issues with CRED’s services, you can approach the Grievance Redressal Department (GRD) in several steps, which have been listed below for your convenience.

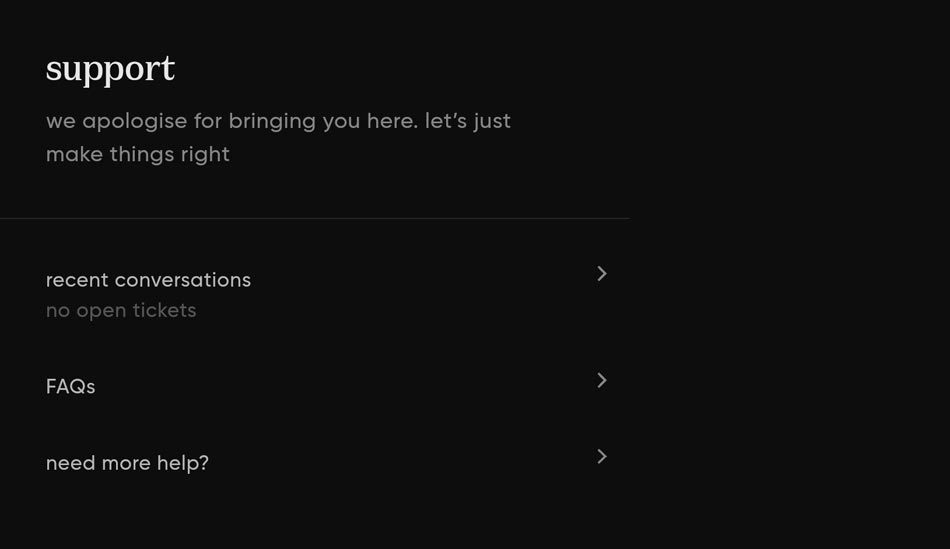

Contact Customer Support: Your first line of support and assistance is the customer service department at CRED. As CRED does not have a customer care number, you can reach out through in-app chat or email.

Escalate to Grievance Officer: If you are dissatisfied with the resolution provided by the customer support team, you have the privilege to escalate the issue to the Grievance Redressal Department (GRD) which is higher up in the hierarchy in terms of power and expertise. You can send an email to the GRD at grievances@cred.club.

Connect via Social Media: For those on social media, CRED does have active presence on Twitter, Facebook and Instagram. You can DM or tweet with the concern that has been bothering you.

Come with all preparedness and be ready to furnish all relevant details related to the issue with the GRD for quick and effective resolution. These would include account details, transaction details, or any other additional information that would be required on their part to close the issue.

You must allow a reasonable timeframe for the GRD to revert to you with a suitable resolution after you have submitted your complaint. The team will investigate the issue and work towards resolving it as soon as possible.

As a consumer, you also reserve the right to go higher up on the ladder to seek redressal if you are not happy at the lower levels. You may file a complaint with the Reserve Bank of India’s (RBI’s) Banking Ombudsman, but that is often unnecessary because minor to critical problems are efficiently handled by the Grievance Redressal Desk at CRED.