For people who drive, cars are not just a mode of transport but instead a trustworthy companion. Being able to traverse from one point to another without having to depend on a third party is always a luxury that many would love to have. However, there can also be moments when an accidental breakdown may take place and your four-wheeler buddy will not be able to continue any longer. Times like these are when you need the assistance of AWN Insurance.

Based in Australia, AWN Insurance specializes in providing insurance policies that cover your expenses in case your vehicle mechanically breaks down. With AWN’s MBI (Mechanical Breakdown Insurance), you get access to additional warranty coverage beyond what your car manufacturer provides, as well as warranty coverage for older cars, including a broader range of component repairs and breakdowns. What make the company unique in their approach is their overall expertise, choice of coverage, independent network of service providers across Australia, and seamless claims process.

If your car is covered by AWN Insurance and you are looking to file a claim right away, then our expansive guide will provide you with all the information you need to complete your objective.

Steps to Submit Claim Online

AWN Insurance allows you to submit a claim for your insurance policy online. To do that, follow the recommended steps mentioned below.

- Start by first heading over the official ‘Make A Claim’ website here.

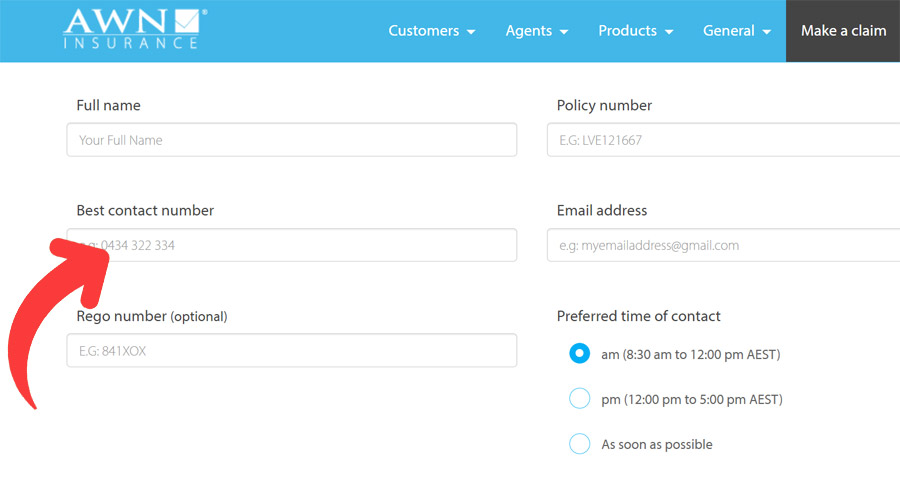

- On the landing page, you will be presented with an online claim form that you need to fill out.

- The primary step involves putting in your personal details, such as your full name, policy number, contact number, and email address.

- After that, you need to put your Rego number (optional), your preferred time of contact (as the company’s customer support will get back to you), and your overall description of the issue for which you are raising the claim (limited to a maximum of 300 characters).

- Once done, click on ‘Send Claim Enquiry’ and wait for an official response.

Keep in mind that once you submit the aforementioned online form, the AWN Insurance claims team will contact you to discuss the issue within the next business day.

Once a complete diagnosis has been made and an acceptable repair report along with the cost is received by the company, the claims assessment team will notify you of the approval. After approval is received, the claims team will interact directly with the repairer to get your vehicle sorted out.

Other Ways to Submit Claim

In addition to submitting your claim online, you can also complete the process either over the phone or via email, as explained in the steps provided below.

Submitting Claim Via Phone

- Begin your journey by first giving a call to the AWN Insurance customer support at (07) 3802 5577. Phone lines are available from Monday to Friday, between 8:15 AM and 5:15 PM (AEST).

- Navigate through the on-call options and proceed to speak to a customer care representative.

- Once a live agent connects to your call, provide your policy details, full name, and the incident that led to you submitting a claim.

- After all the required information is gathered by the customer care representative, a claim request will be registered under your name and insurance policy.

- Lastly, you have to wait for an official response from the company’s claims department.

Submitting Claim Via Email

- First, you need to draft an email from your registered email address.

- In the email, state your name, phone number, residential address, policy details, and a complete description of the issue. Remember to always stay precise and professional in your approach so that your problem can be easily understood.

- Additionally, you can even attach files or documents with your email as required.

- Once done, send the email to the following email address: claims@awninsurance.com.au.

- After that, you need to wait for an official message or response from the company’s claims assessment team.

Overview of Products

Primarily operating in Australia, AWN Insurance specializes in protecting your assets through various insurance products and services. The company’s core competency lies in offering MBI, or ‘Mechanical Breakdown Insurance’ policies to protect you against unexpected and expensive car repairs. AWN has more than 25 years of experience in this field, and their plans can easily cater to different budgets and coverage requirements.

Additionally, the company offers administration and claims management services to businesses to help them carry out various insurance-related tasks, such as policy administration and claims processing, in an efficient manner. Also, some of the insurance policies from the company provide roadside assistance to vehicle owners for added peace of mind. And lastly, the company offers training programs to agents and partners so that they can effectively promote and sell various AWN Insurance products and services.

For any additional assistance, you can visit AWN Insurance’s head office at Pacific Highway, Tanah Merah, QLD 4128, Australia.