Air India has been India’s most prominent airline since the 1930s. Synonymous with the nation’s aspirations for global connectivity and economic growth, the company has played a pivotal role in shaping the country’s aviation landscape. Initially founded as Tata Airlines, the operator was later nationalized and renamed to Air India, shortly after India’s independence. As a result, it enjoyed unfettered support from the Indian government, allowing it to provide excellent service and efficient performance.

The turn of the 20th century, however, brought whole new challenges for Air India, such as a rise in fuel costs, internal financial difficulties, and increased competition from low-cost airlines such as IndiGo and GoAir. This prompted it to undergo privatization, which ultimately concluded in 2022 as Air India became a part of the Tata Group yet again. Today, the company operates as India’s flag carrier, offering domestic and international flights through its multitude of Airbus and Boeing aircraft.

If you have recently booked a flight through Air India and want to obtain the GST (Goods and Services Tax) invoice for the transaction you made online or via your travel agent, then you can effortlessly do so by following our in-depth guide below.

Steps to Get Tax Invoice on Web

Air India states that GST or tax invoices will be processed based on the GSTIN (GST Identification Number) details provided at the time of travel or ticket booking and will be mailed within 4 days, directly to the email address provided at the time of booking.

However, there are times when you may not receive the invoice within the slated period, or you may require an updated or revised invoice, for which you need to visit the official Air India GST Portal.

Through the official portal, you will be able to register with your GSTIN ID, view or update your tax information, download GST invoices seamlessly, and download TCS (Tax Collected at Source) data over the air without fail.

To start the process right away, follow the recommended steps provided below.

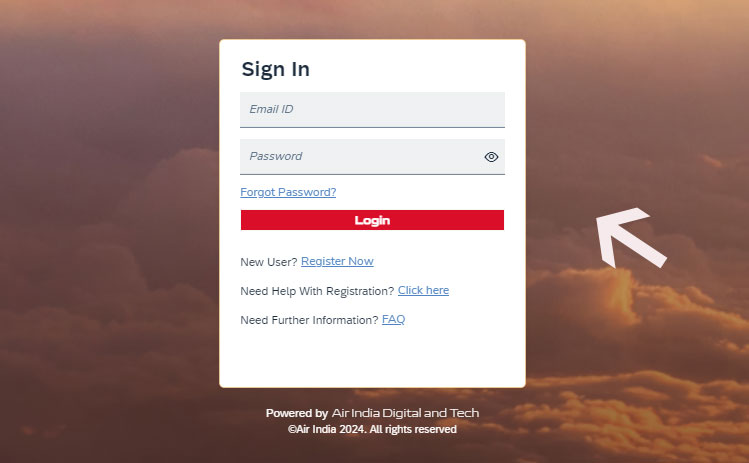

- Start your journey by first visiting the official website.

- On the landing page, you will be asked to either sign in to your account using your email ID and password or simply register as a new user.

- If you are registering as a new user, then you will be required to state your PAN (Permanent Account Number) as well as your preferred email address (which will be the primary mode of communication).

- Once registered and signed in, you will be able to view as well as download GST invoices related to the previous bookings you made with Air India by simply providing your booking reference number.

Keep in mind that refunds of GST will not be allowed after 1st October of the current financial year for the invoice(s) issued in the previous financial year.

How to Request via Email

If you are facing errors while registering on Air India’s GST portal or while downloading your tax invoices, then you can request your GST invoice through the listed steps mentioned below.

- Begin your journey by first drafting an email from your registered email address (as registered on the Air India GST portal).

- In the email subject line, state ‘GST Invoice’, and in the email body, provide all the necessary details necessary for obtaining the tax invoice. These include your registered name and address, GSTIN ID, booking reference number, and registered phone number.

- Once done, send the email to the following address: gstsupport@airindia.com.

- After sending the email, you need to wait for a follow-up response from Air India’s customer support.

How to Request via Support Form

In addition to obtaining your GST invoice for the booking you made with Air India through the aforementioned processes, you can also directly contact the airline operator’s customer support by simply filling out a web form. However, keep in mind that this process is only suggested if neither of the above-mentioned solutions work for you.

To kickstart the request process, carry out the steps outlined as follows.

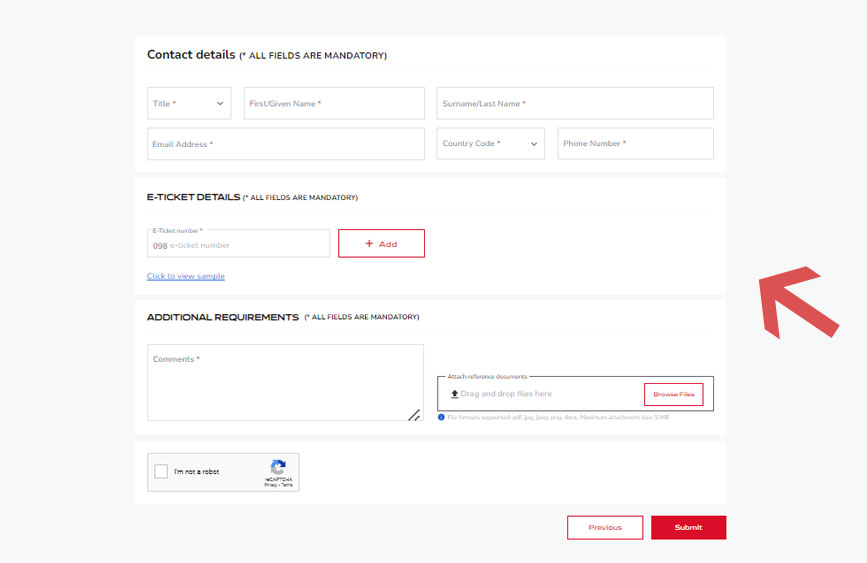

- The primary step involves heading over to the official booking support page for Air India.

- Select ‘GST Invoice’ from the list of options, and upon doing so, you will be presented with a web form that you need to fill out.

- First, provide your full name, email address (preferably the one that was used for the ticket booking), and phone number. After that, provide your e-ticket number, as stated on your transaction slip or receipt.

- Once done, state that you want to obtain the GST invoice for the booking you made in the given comment box, and eventually click on the ‘Submit’ button to finalize your submission. You can also provide your transaction receipt through the upload file option to customer support.

After submitting your request, it is imperative that you wait for an official reply or follow-up from Air India’s customer support in due time.

For any further assistance, you can get in touch with the customer support at 0116 932 9333/0116 932 9999 (domestic) or +91 116 932 9333/+91 116 932 9999 (international). Phone lines are in operation 24×7.