One of the oldest and the most powerful in the US, Amica Mutual Insurance Company was founded in 1907 and is headquartered in Lincoln, Rhode Island. Amica is the country’s highest rated and among the most trusted insurance companies that deal with a variety of products, primarily automobiles. If the company has held onto its own and has been successful in retaining a spotless reputation for over a century it is because they are America’s exceptional service provider.

Amica also specializes in providing home, liability, and life insurance.

Customers are often confused over which company to choose and make head-to-head comparisons before finalizing the ones that offer them the best deals.

Amica’s cornerstone of success lies in its customer relations and ‘award-winning customer service’. They listen, note, analyze, and then recommend what best fits your needs.

Amica offers 109,000 policies. The company offers many benefits which include loyalty discounts (the longer you stay with the company, the more discounts you enjoy on their products); depending on your state of residence, you can get an off up to 30% on home and auto insurance policies when bundled together (at Amica); they give out dividends to their policyholders when they are profitable and you can bank on getting a flat 20% off for that financial year.

An A+rated company, Amica’s policies cost $1378 annually on average. Subsidiaries of Amica Mutual Insurance Company are Amica Life Insurance Company, Amica Property and Casualty Insurance Company, and Amica General Agency.

Know the Insurance Types and Coverages

Protect yourself, your car, and your loved ones with auto insurance covers that takes care of after-accident expenses like medical bills, lost wages, loss of services, funeral expenses (God forbid), vehicle damage expenses, damage to other kinds of property, accident-related repairs, vehicle replacement, and a host of others depending on which insurance you are signing up for. The features will vary with different policies.

In the event that your home is destroyed in a fire, lightning, or by any other natural or external agents, you are safely covered by Amica’s standard and platinum choice home coverages.

Life can spring unexpected (and unwanted) surprises when you are least expecting them. It is important to get yourself and your loved ones covered fully just so that you are not inconvenienced by the untoward. You need term and/or whole life insurance for meeting unexpected expenses of all types of life-changing events like career, marriage, buying a home, parenting, raising a family, education, accidents, retirement, death, etc.

Life insurance at Amica will make you eligible to get discounts on auto policies; and they are also one of the most affordable policies and the best-rated ones in the country. Now, if you ever need to file a claim, the following section will guide you on the best ways to move ahead at Amica.

1) Submit a Claim Instantly Online

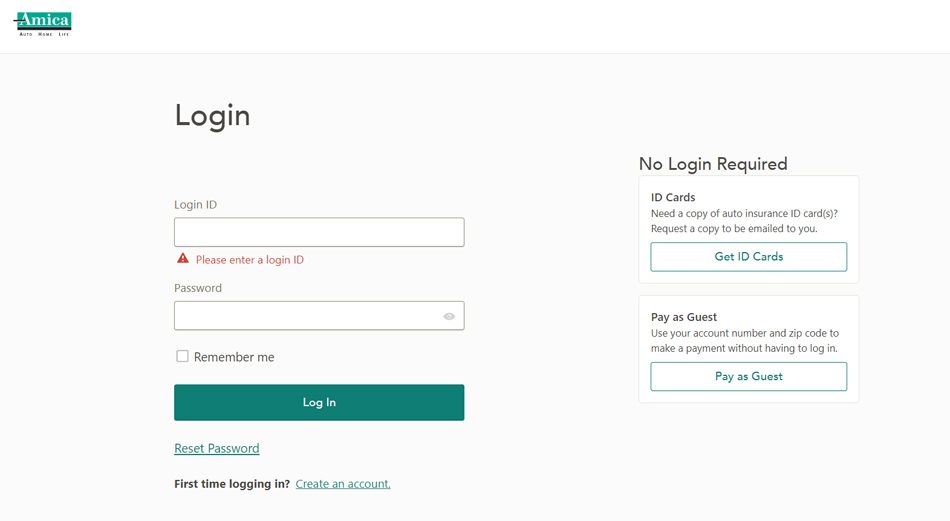

Log into your Amica account to file claims online. Click on the link here to log in to report a claim. Note that you need to click on the same to track your claim and upload and view claim documents.

Report an online claim if you are the victim involved in an accident. You will need to gather as much information as you can about the names and contact details of the people involved in the accident, the accident site, the model and plate numbers of the cars, and a police report (if not needed immediately, they will eventually ask for it to settle claims).

Grounds for home insurance claims are burglary, damage by fire, floods, earthquakes, wind, hailstorms/cyclones, or by any other means that renders your home inhabitable. Get in touch with Amica representatives at the earliest and file an online claim. The claim handler will contact you to discuss a good day and time to fix an appointment with the adjuster.

In whatever situation you find yourself in, the first step would involve filing a police report. Amongst the other records that you might need to upload are pictures of the damaged portions of the house, receipts of valuables, a photo inventory of the inside and outside of your house, and additional information if requested. Amica agents will visit your home to inspect the extent of the damage; they will offer the maximum coverage depending on the type of your policy.

The claim payments could be online or via a check. You have the option to select the payment mode. As for life insurance claims, you will need to fill in the manner and cause of death of the policyholder on the web form if you are a beneficiary. Upload a certified copy of the death certificate.

2) Call the Customer Support Helpline

You can call or chat with Amica’s Virtual Assistant online to explain your reasons for the claim. The representatives are available on the live chat option on weekdays between 8 am and 9 pm. On Saturdays, they are available between 10 am and 5:30 pm.

The phone is usually the preferred option during emergencies such as filing claims. It is more assuring to talk to someone who can guide us confidently through the process and assures the best help under the circumstances.

Claim representatives for auto and home are available round the clock at 800-242-6422. Representatives for life claims are available on weekdays between 8:30 am and 5:00 pm at 800-234-5433.

If you want to submit claim documents or questions by postal /direct mail, please send them to the address below –

Claims

Amica Scan Center

PO Box 9690

Providence, RI 02940-9690

3) Visit the Nearest Branch

If despite the above you are not sure of assistance on claims, you can choose to locate their branch nearest to your place of residence. Visit them in person and explain your situation to the officers for them to start the process. Remember to carry all the requisite original documents and receipts, along with a police report so that the processing gets underway without further delay.

Click on the link here and enter your city, state, and zip code in the white box on the page to view your nearest Amica branch. On the same page at the bottom, they ask you to complete their contact form, and your email gets directed to the right inbox for someone to revert to your claim queries.