Headquartered in Illinois, United States, Allstate features in the country’s top five insurance companies that started in the 1930s and are around for more than 88 years. Today it has a strong presence in all the US states. Though it began as a motor insurance agency, it eventually expanded to sell other categories like life, health, and business insurance in the 1950s. Its recent and famous tagline “It’s good to be in good hands” is a modification of the older “You are in good hands with Allstate.”

Allstate is also a widely diverse and inclusive one, and easily one of the best companies to work with. In a 2017 edition, Forbes’ magazine listed them as America’s best large employers. Some of the other subsidiaries of Allstate are — Esurance, SquareTrade, Allstate India, Encompass Insurance, Allstate Canada, Allstate Northern Ireland, Answer Financial, and Arity. It is a company with a reasonably good financial strength so you can be confident that your claim money would be paid in time without any hassle.

The average annual insurance cost at Allstate is $696. It offers a range of customizable insurance packages with great protection. Some of Allstate’s attractive discount features include — Anti-Lock Brake, Anti-Theft, Multi-Policy, Early Sign-On, Responsible Payer, New Car, Smart Student, Easy-Pay plan, Allstate Smart discount, Full-Pay, and Safe Driving Club.

Know the Types of Insurance and Coverage

Vehicle Insurance – This would include cars, motorbikes, ATVs, RVs, etc. Types of coverages are collision, comprehensive, liability, medical payments, uninsured and underinsured, roadside, and rental reimbursement coverages, besides personal injury protection, and personal umbrella policy.

Property Insurance — Includes homeowners, renters, condo, and landlord. Typically, the policies help to cover repair damages caused by theft, fire or smoke, windstorm, hail, water damage from plumbing, heater, appliances, heating/cooling systems, etc.

Business Insurance — Allstate’s firm financial solutions protect your business against potential risks that could otherwise sabotage its existence. Visit their official website to glean through the options that suit your type of business the best. Types of business insurance includes Business Owner’s Policy, Property Coverage, Liability Coverage, Business Interruption Coverage, and Equipment Breakdown Coverage. Get in touch with your Allstate agent to brief you more on other details.

Life Insurance — Taking life insurance with good payout benefits would mean planning ahead in life and being prepared for the worst, also protecting your loved ones from unexpected expenses in your absence. There are multiple coverage plans but much would depend on what suits you best. Usually life insurance policies cover the costs of funerals, school/college education of children, outstanding debts, childcare, regular family expenses, etc, to prevent putting your family under the spot in your absence.

Others — Include coverage policies for pets, travel, events, etc.

Allstate has a powerful claims processing system in place, but depending on the severity of the accident and circumstances the time taken to process claims could vary anywhere between 2 weeks to a few months.

Here’s what you should know to submit claims at Allstate.

1) Submit a Claim Online with Few Simple Steps

Any time that you are involved in an accident, your first line of action should be to let Allstate representatives know in detail what happened, how, when, and where. Filing a claim will not only prevent you from losing coverage but will also protect you from future lawsuits.

If it’s an at-fault accident, you will have to pay your deductibles before you get policy benefits. If you are a registered Allstate customer, you can easily file a claim online by logging into your account. Keep the following information handy to help you fill up the web form without delay — contact information of people involved in the crash; vehicle information (both the cars/bikes involved in the crash); insurance information of both; clear pictures of the damaged vehicle; date, time, and location of the accident; police report; and names of officers who handled the accident case.

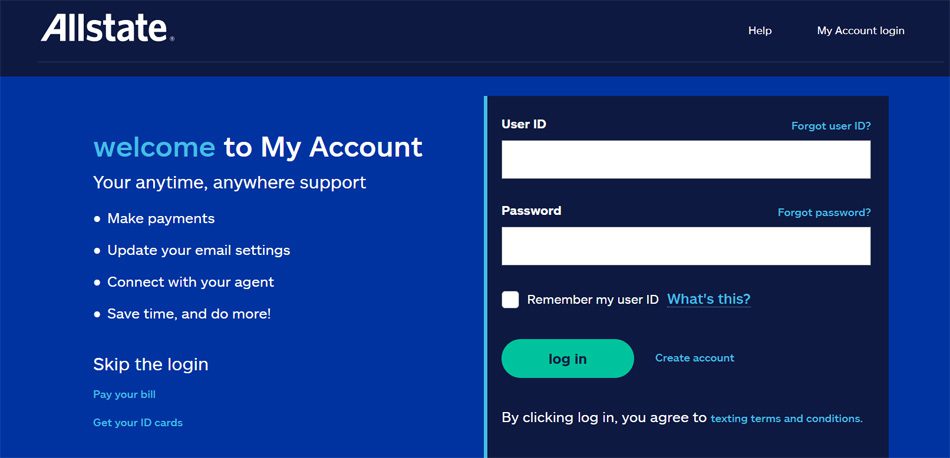

You can enter all details by logging into MyAccount, or you may choose to upload some information later when you have them in hand. You must upload additional (if there’s a requirement depending on the state you reside in) documents, more pictures, and track your claim once you have filed your claim. You can then connect with an Allstate agent on MyClaim. Visit the link here for auto claims.

For home or property claims, the process is pretty much similar except that you provide different set of information like — contact information of the contractors on your home job; photos of damage; date when the incident occurred; and details of the items damaged and the extent of damage.

You will be provided a claim number to track the status of your claim. For life insurance, visit the link here. The following are the information that you need to provide — full name; policy number; Social Security Number; date of birth; date of death; place of death; and policyholder’s certified death certificate.

Filing an online claim with Allstate is easy. Visit their official website and click on the hyperlinked text that says file a claim online. Choose your claim type and enter the essentials and submit the claim. You will receive a claim number to help you track it. Allstate’s claim team gets on task to ensure if you are eligible for the claim and if you are, they get things underway.

2) Speak to the Customer Service via Phone

If you need assistance on the phone, you can call 800-669-2214 or 1-800-676-5456 (general queries). Call 1-800-366-3495 for someone from Allstate to help you with the claim submission process for life insurance. You can also write to lifeprotection@allstate.com.

Alternatively, you can download the Allstate app on Android or iOS as you can instantly get connected with an agent, choose modes of communication, manage your claims and even upload pictures of your mangled car after the accident, and do more.

3) Visit the Nearest Branch to Initiate Claim

Allstate has nearly 12,000 agencies so you can easily walk up to live agents to help you report, submit, and settle claims to an area near you. With its presence all over America it is highly unlikely that you will not find an Allstate insurance agent near you to get things through.

You can click on the link here to get connected agents to help you with auto, home, or life insurance claims. Just enter your zip code, location (city/state) and hit ‘Search’ to find a suitable agent near you. There are close to 20,000 independent agents working for Allstate; if you have signed for one, maybe you can enlist their help with claims processing which should be more convenient on your part.